Charting Oil & Gas | The Golden Year 2022 and what lies ahead

Exploring some of the largest oil firms' 2022 performance, strategies, and shift towards sustainable and renewable energy solutions amidst market challenges.

As we delve into the current state of the energy industry, we turn our focus to the world's most prominent oil companies, analyzing their performance in 2022 and charting their future course. In this exploration, we will examine how these oil giants navigated the ever-changing market conditions and the impact of global events on their financials, while also shedding light on their latest endeavors to transition towards sustainable and renewable energy solutions.

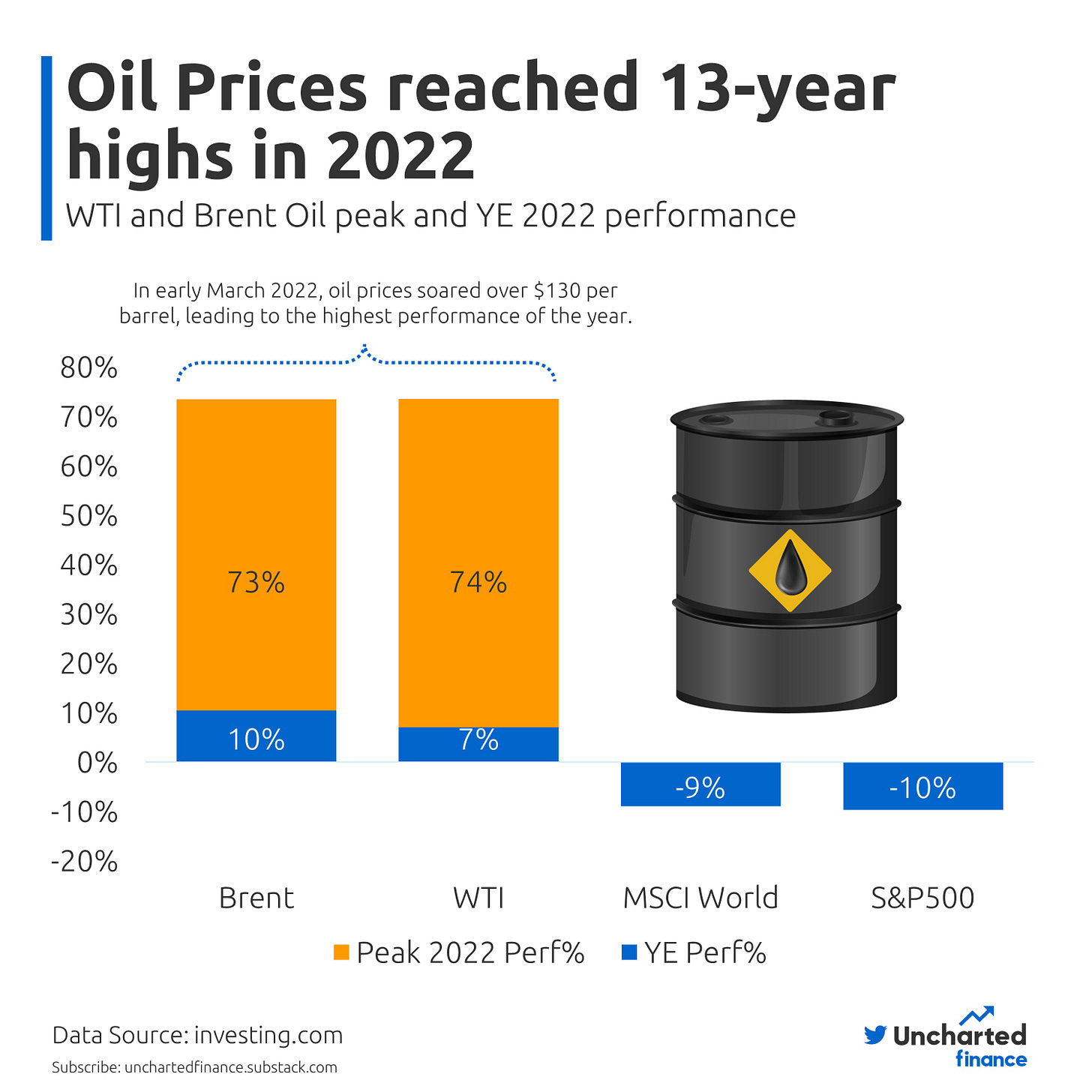

Oil Producers Benefit from Geopolitical Factors While Other Sectors Struggle

The conflict between Russia and Ukraine and the OPEC oil production cut had a favorable impact on oil producers as oil and gas prices soared to over a decade high. On the other hand, many companies in the technology, fast-moving consumer goods (FMCG), and other sectors struggled to maintain their margins due to cost pressures, while oil and gas producers experienced record profits.

As a result of higher realized prices, these companies were able to generate massive profits, achieving a combined EBITDA and free cash flow of $293 billion and $166.5 billion, respectively, during FY 2022.

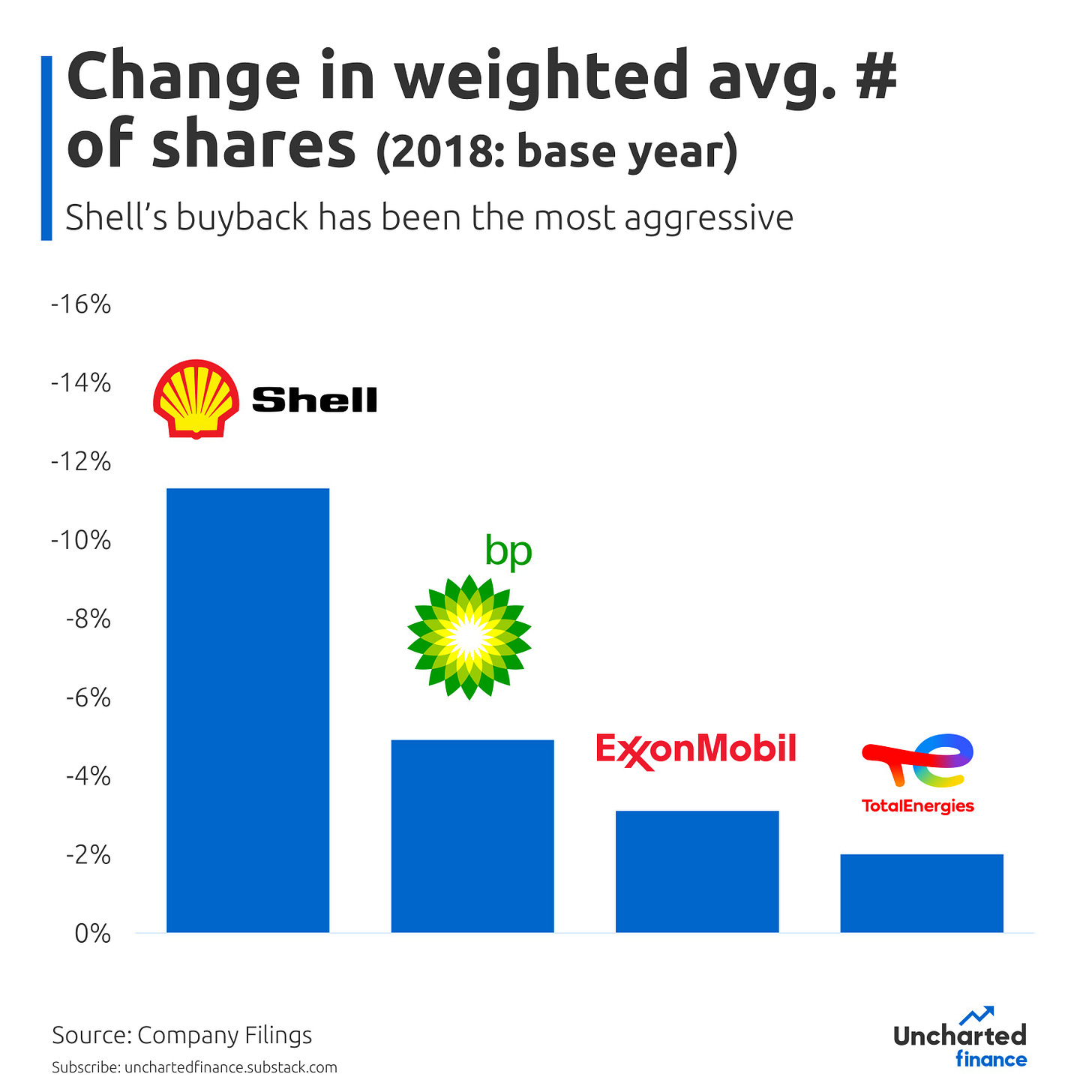

This enabled them to distribute dividends and carry out significant share buybacks, thereby rewarding their shareholders.

According to BP's latest projections, assuming Brent crude prices hover around $60 per barrel and are subject to board discretion on a quarterly basis, the company anticipates facilitating share buybacks totaling roughly $4.0 billion annually while still remaining within its capital expenditure parameters. Additionally, BP intends to augment the dividend per ordinary share by approximately 4% each year.

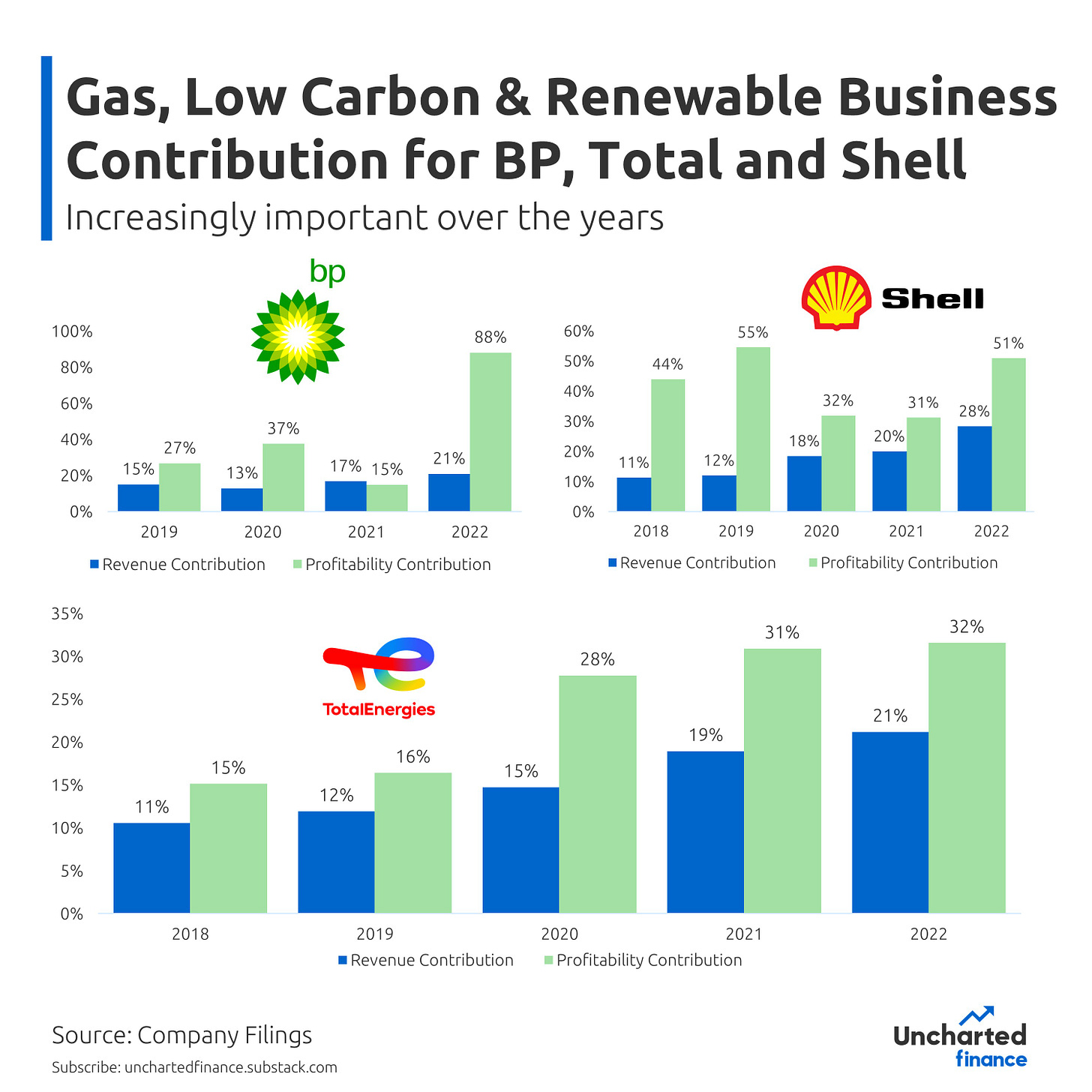

BP, Total, and Shell have been rapidly transitioning towards low-carbon and renewable energy ventures, whereas Exxon has chosen to concentrate on low-carbon solutions by commercializing business opportunities that involve carbon capture and storage, hydrogen, and lower-emission fuels.

Recap of Exxon, BP, Shell, and TotalEnergies Performance in 2022 and Outlook for 2023

2022 Recap

In 2022, BP exhibited a strong financial performance across four consecutive quarters. The company has increased its dividend by 21% since 4Q 2021, decreased net debt by $9.2 billion, and executed disciplined investments, in addition to announcing $11.25 billion worth of share buybacks.

Prior to 1Q 2023, they plan to use their cash flow surplus to implement a share buyback program totaling $2.75 billion.

2023 Guidance

BP expects a slight increase in its underlying production from oil production and operations, while production from gas and low-carbon energy is anticipated to decrease.

Depreciation, depletion, and amortization are expected to be slightly above 2022.

Capital Expenditure: $16-$18 billion

Divestment: $2-$3 billion

For 2023, BP remains committed to using 60% of surplus cash flow for share buybacks.

2022 Recap

A share buyback program worth $4 billion will be implemented, with the expectation that it will be completed by the time the first-quarter 2023 results are announced.

Compared to the previous year, Shell PLC shareholders saw an increase in their full-year income, which was attributable to higher realized prices, refining margins, and trading and optimization results, particularly in the areas of Integrated Gas, Chemicals, and Products, as well as Renewables and Energy Solutions. However, this growth was partly offset by a decline in volumes and lower chemicals margins.

Outlook for 1Q 2023 and 2023

Capital expenditure (Full-Year): $23-$27 billion

Marketing sales volumes (1Q 23): 2,150-2,650 thousand b/d (4Q 23: 2,543 b/d; 2023: 2,503 b/d)

Refinery utilization (1Q 23): 87%-95% (2022: 86%)

Chemicals manufacturing plant utilization (1Q 23): 68%-76% (2022: 79%)

2022 Recap

Prior to Q1 2023, Total Energies plans to use its cash flow surplus to implement a share buyback program totaling $2 billion.

In 2022, the company's cash flow reached $45.7 billion, while its IFRS net income amounted to $20.5 billion, which included approximately $15 billion in provisions linked to Russia. After adjusting for these provisions, the company's net income amounted to $36.2 billion. Additionally, the company achieved a 32% return on equity and a 28% return on capital employed.

2023 Guidance

Oil prices are fluctuating between $80-90/b at the start of 2023, amidst an uncertain environment where a potential global economic slowdown could be offset by China's recovery. The demand for oil is expected to exceed 100 Mb/d in 2023, prompting OPEC+ countries to indicate their intention to maintain prices above $80/b. In Europe, refining margins, particularly for distillates, are anticipated to remain buoyed by the impact of the European embargo on Russian petroleum products from February 5, 2023.

Ongoing tensions in European gas prices in 2023 are expected due to limited growth in global LNG production, which must meet increased demand from both Europe (replacing Russian gas from 2022) and China.

Expected net investment: $16-$18 billion ($5 billion dedicated to low-carbon energies).

Hydrogen production is expected to increase by 2%.

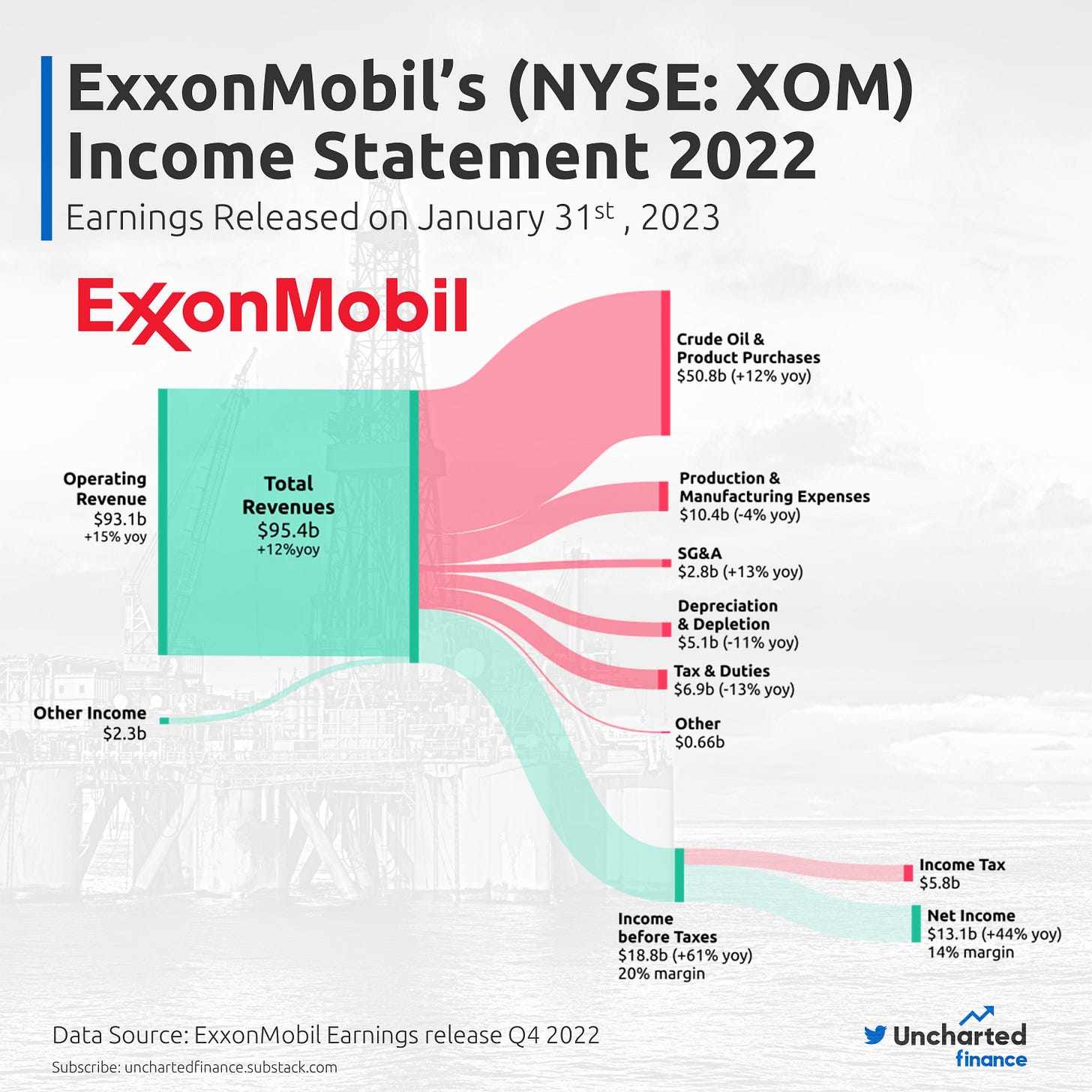

2022 Recap

In 2022, full-year earnings amounted to $55.7 billion, a significant increase of $32.7 billion from the previous year's earnings of $23.0 billion. However, identified items had an unfavorable impact of $3.4 billion, primarily due to Sakhalin-1 impairments in Q1. Excluding these items, earnings reached $59.1 billion, representing an increase of $36.1 billion compared to the prior year.

In 2022, the company's cash increased by $22.9 billion, with free cash flow amounting to $62.1 billion. Shareholder distributions reached $29.8 billion, consisting of $14.9 billion in dividends and $14.9 billion in share repurchases. Moreover, the company extended its share-repurchase program and increased it to include up to $35 billion in cumulative share repurchases during 2023-2024.

Bonus: How Exxon makes its money

Biofuels and Hydrogen Project details

ExxonMobil plans to develop the world's largest low-carbon hydrogen facility in Baytown, which will produce 1 billion cubic feet of low-carbon hydrogen per day, starting in 2027-2028. Over 98% of the associated CO2 (around 7 million metric tons annually) is expected to be captured and stored, and the carbon capture and storage network will be available for third-party CO2 emitters in the area.

ExxonMobil's affiliate, Imperial Oil, will invest $560 million to build Canada's biggest renewable diesel plant. The Strathcona Refinery project will produce 20,000 barrels of renewable diesel per day from local feedstocks and reduce greenhouse gas emissions by 3 million metric tons yearly in the Canadian transportation sector.

Bottom line

Overall, the oil and gas industry has seen a successful year in 2022, with companies such as BP, Shell, Total Energies, and ExxonMobil achieving record profits. These companies are continuing to invest in new technologies and make the transition to low-carbon energy sources while still rewarding shareholders with dividends and share buybacks. It will be interesting to see how the industry continues to evolve in the coming years.

DISCLAIMER: The information provided on this blog is for informational purposes only and should not be considered financial advice. The content on this blog is not intended to be a substitute for professional financial advice, and we recommend that you seek the advice of a qualified financial advisor before making any investment decisions. We do not guarantee the accuracy, completeness, or reliability of the information on this blog, and we will not be held responsible for any errors or omissions or any actions taken based on the information provided. The views and opinions expressed on this blog are those of the authors and do not necessarily reflect the official policies or positions of any company or organization.