Charting the U.S. Cannabis Industry | Legalization, Market, and Investment Opportunities

The marijuana industry in the United States has undergone a rapid transformation over the past decade. Here's what you need to know...

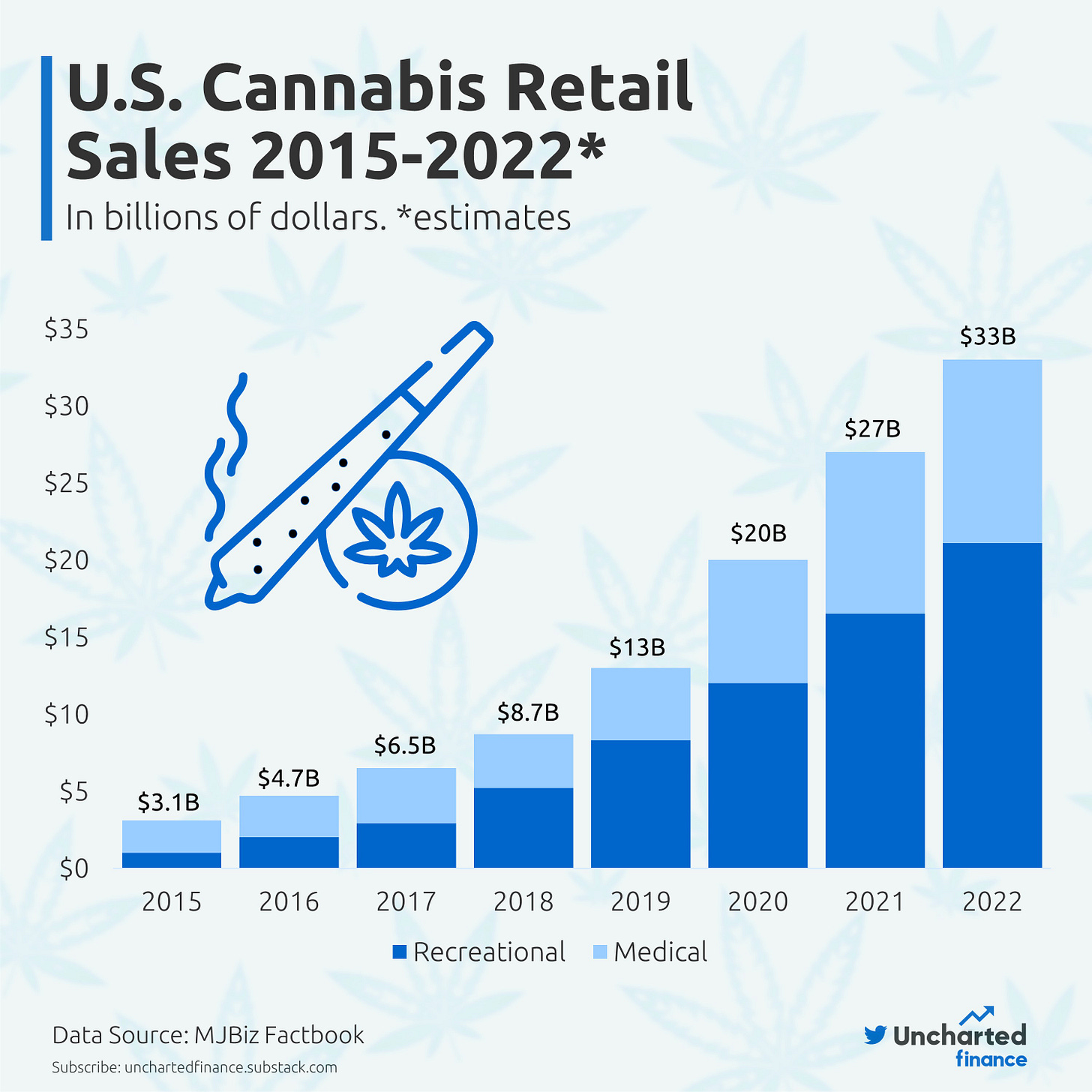

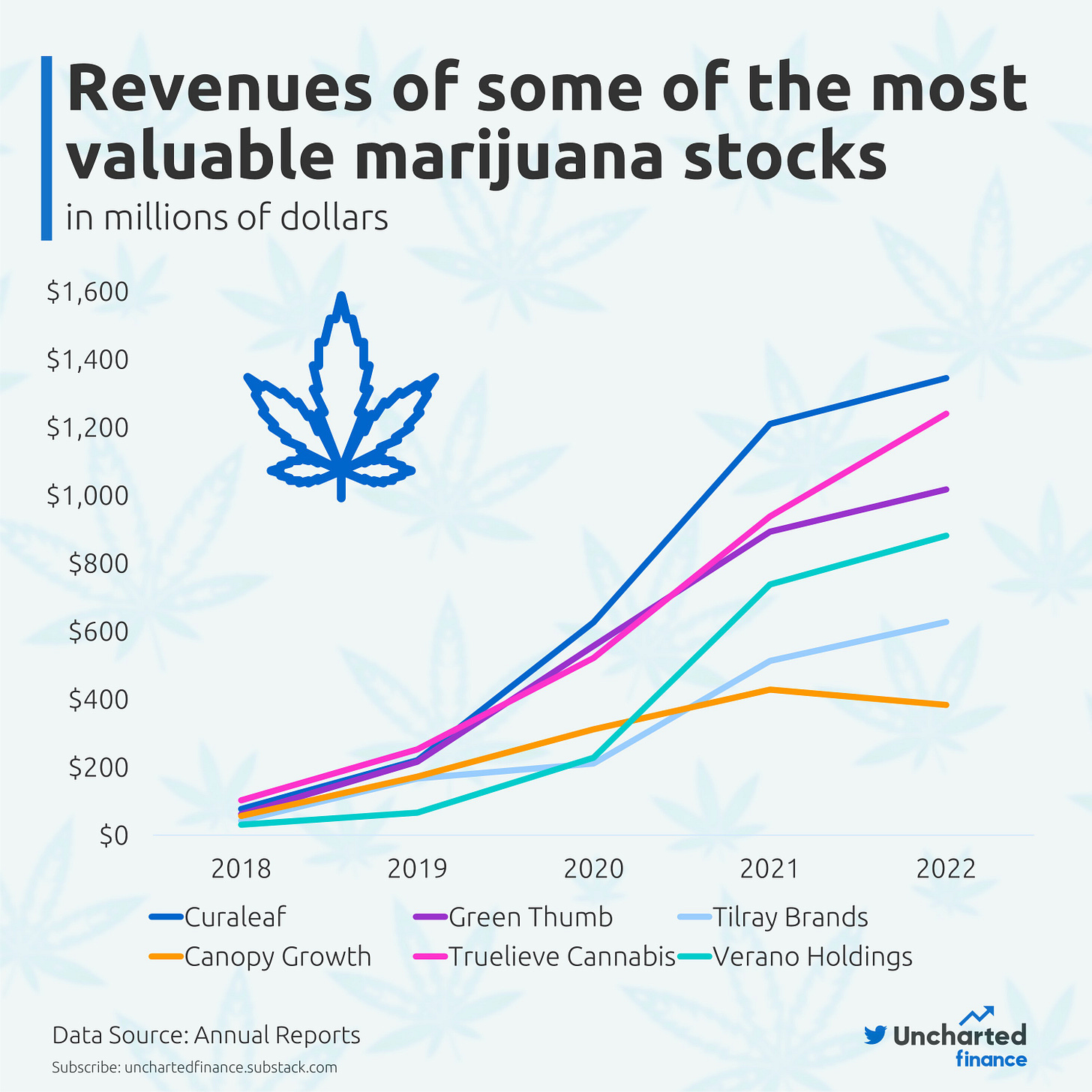

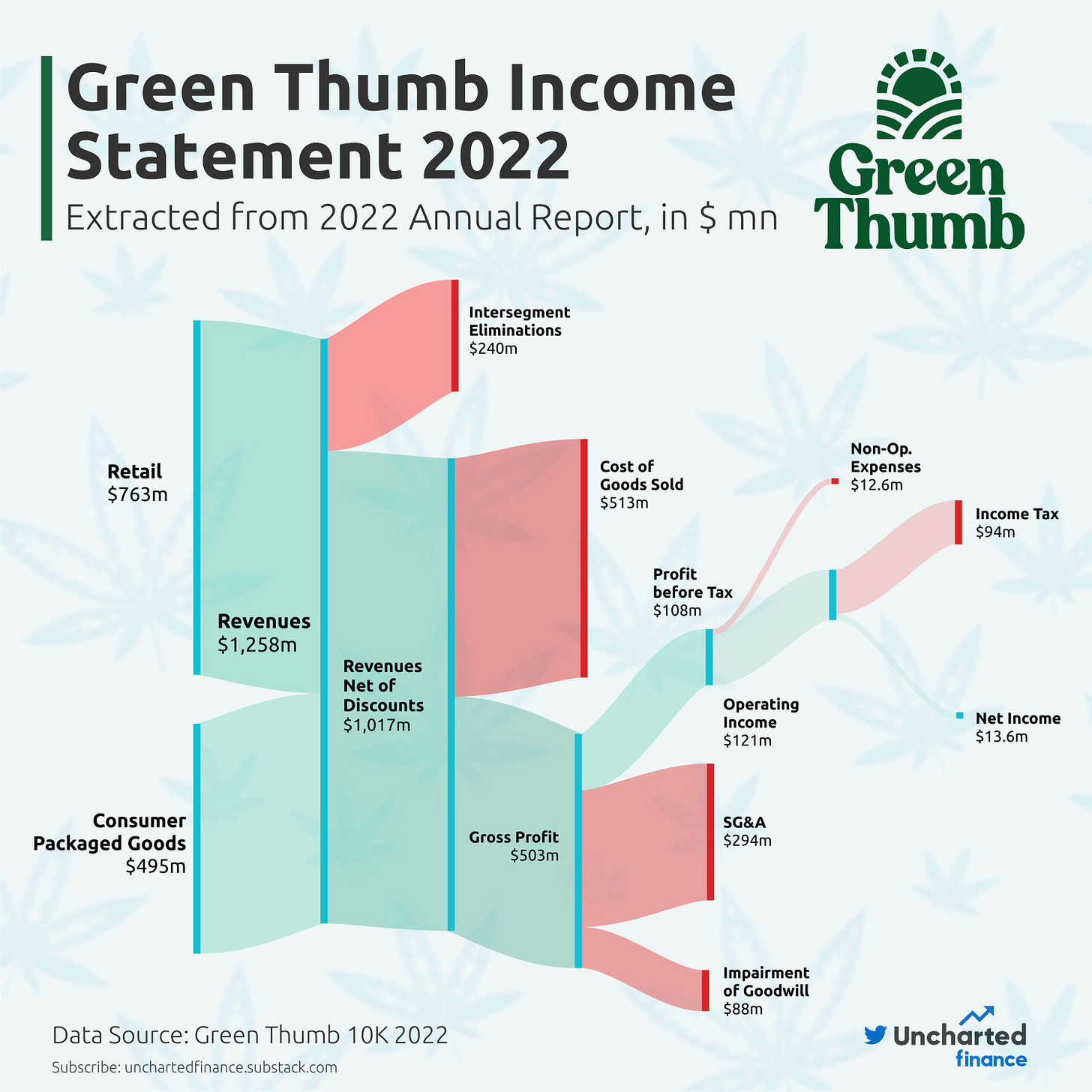

The marijuana industry in the United States has undergone a rapid transformation over the past decade, largely due to increased state-level legalization and growing social acceptance. This has led to significant changes in the industry, with new businesses emerging and existing ones expanding to meet the growing demand. Some of the biggest companies in the industry have experienced remarkable revenue growth, with an average of approximately 100% CAGR between 2018 and 2022.

In this piece, we look at the current state of legalization of the U.S. marijuana industry, market trends, future outlook, and how to invest in the relatively nascent theme.

Where are we now?

The Legalization of marijuana in the United States

Marijuana legalization is a complex issue in the United States, with a growing number of states legalizing cannabis for both medicinal and recreational purposes. As of today, 39 states along with the District of Columbia have legalized medical marijuana while in 21 states and the District of Columbia, the use of cannabis for recreational or adult use has been granted approval.

Despite this growing trend toward legalization at the state level, marijuana remains illegal at the federal level. This creates a challenging legal landscape where individuals and businesses that are operating within state laws could still potentially face federal prosecution.

Federal law and state-legal marijuana industry: Challenges and conflicts

Legalized marijuana has emerged as a significant industry, generating billions of dollars in states where it is lawful, notwithstanding the federal ban. Despite the conflict between federal and state laws on marijuana, the markets are thriving, but issues related to commerce and finance, both of which are under the federal government's complete control, are causing widespread difficulties.

Banking challenges

Banks are hesitant to do business with marijuana companies due to federal anti-money laundering laws.

The SAFE Banking Act bill was designed to allow cannabis companies to access mainstream financial services, as it remains illegal at a Federal level

The bill has so far failed to pass the Senate three times, making cash management a challenge for businesses in the cannabis industry

Cash-only businesses in the marijuana industry are vulnerable to theft.

Interstate trade

Federal law prohibits marijuana from crossing state lines, including among states where the sale of marijuana is legal for medical purposes.

Every year, thousands of pounds of marijuana rot in Oregon because growers can't export it across state lines, even to neighboring Nevada.

Federal Taxation of Legal marijuana Companies

Marijuana companies in states where marijuana is legal still have to pay federal taxes, despite marijuana being illegal under federal law.

These companies cannot take advantage of the same tax deductions and credits as other legal businesses.

They are required to file federal tax returns and often use a provision of the tax code, known as Section 280E.

Section 280E allows them to deduct only the cost of goods sold and not other business expenses.

This results in higher federal tax bills for marijuana companies compared to other businesses with similar revenues.

Research limitations

Federal marijuana laws severely limit access to the plant for researchers, hindering knowledge about its effects and risks.

Scientists at universities and private labs who receive federal money must abide by federal marijuana laws and regulations, regardless of state marijuana laws.

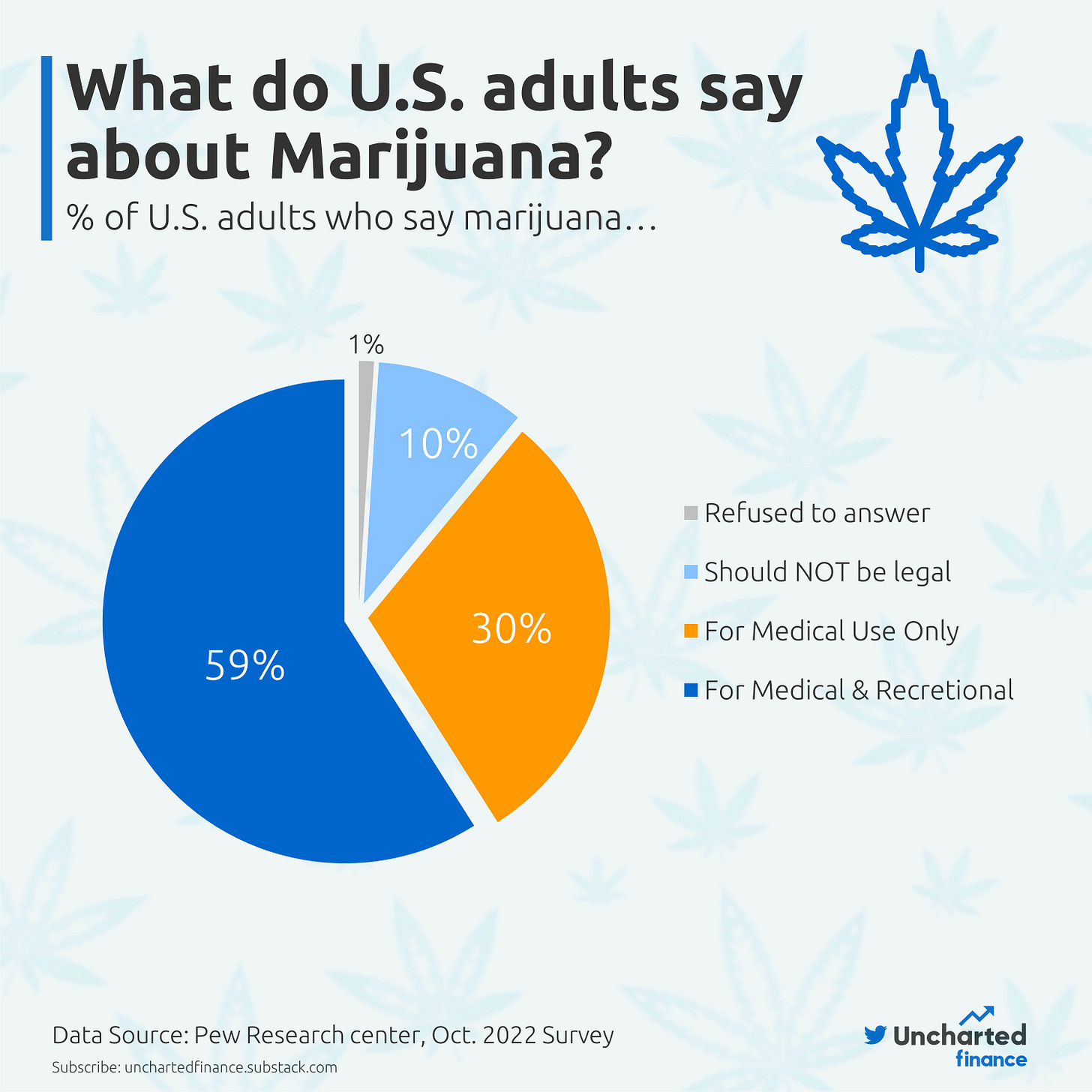

What do U.S. adults say about marijuana?

Around 60% of U.S. adults support the legalization of medical and recreational marijuana, according to a survey conducted by Pew Research Center.

Marijuana Consumption in the United States

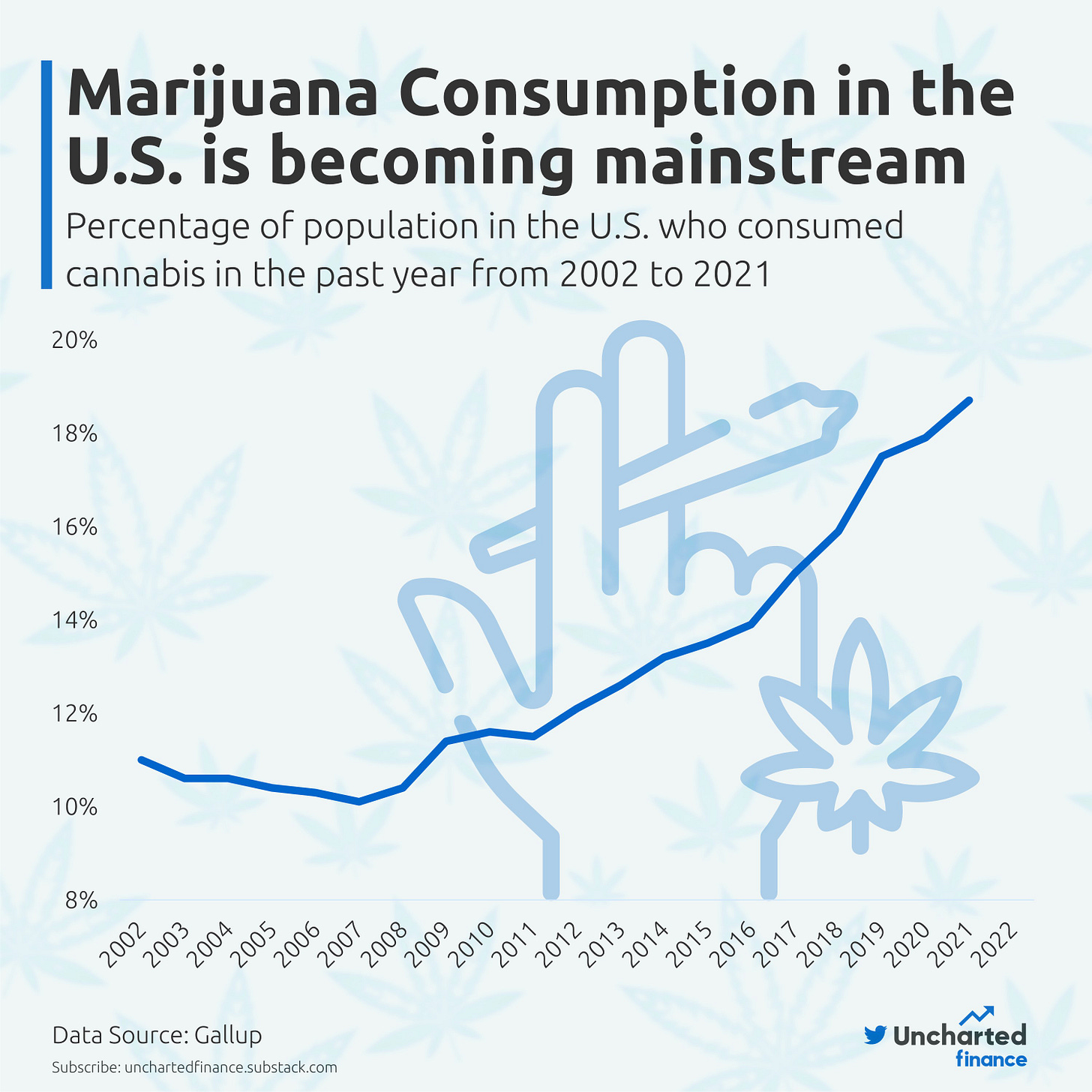

Recreational and medical marijuana consumption in the US has been increasing in recent years:

What’s driving the trend?

Legalization: The legalization of marijuana in many states has made it more accessible and socially acceptable, which has led to an increase in consumption.

Medical benefits: Medical marijuana is becoming more widely accepted as a legitimate treatment option for a variety of health conditions, leading to an increase in consumption among patients seeking alternative treatments.

Cultural shift: Attitudes toward marijuana use have been changing, with younger generations more likely to view it as less harmful than previous generations. This cultural shift has contributed to an increase in consumption.

Economic benefits: The potential economic benefits of the industry, including job creation and tax revenue, have led to increased support for legalization and consumption.

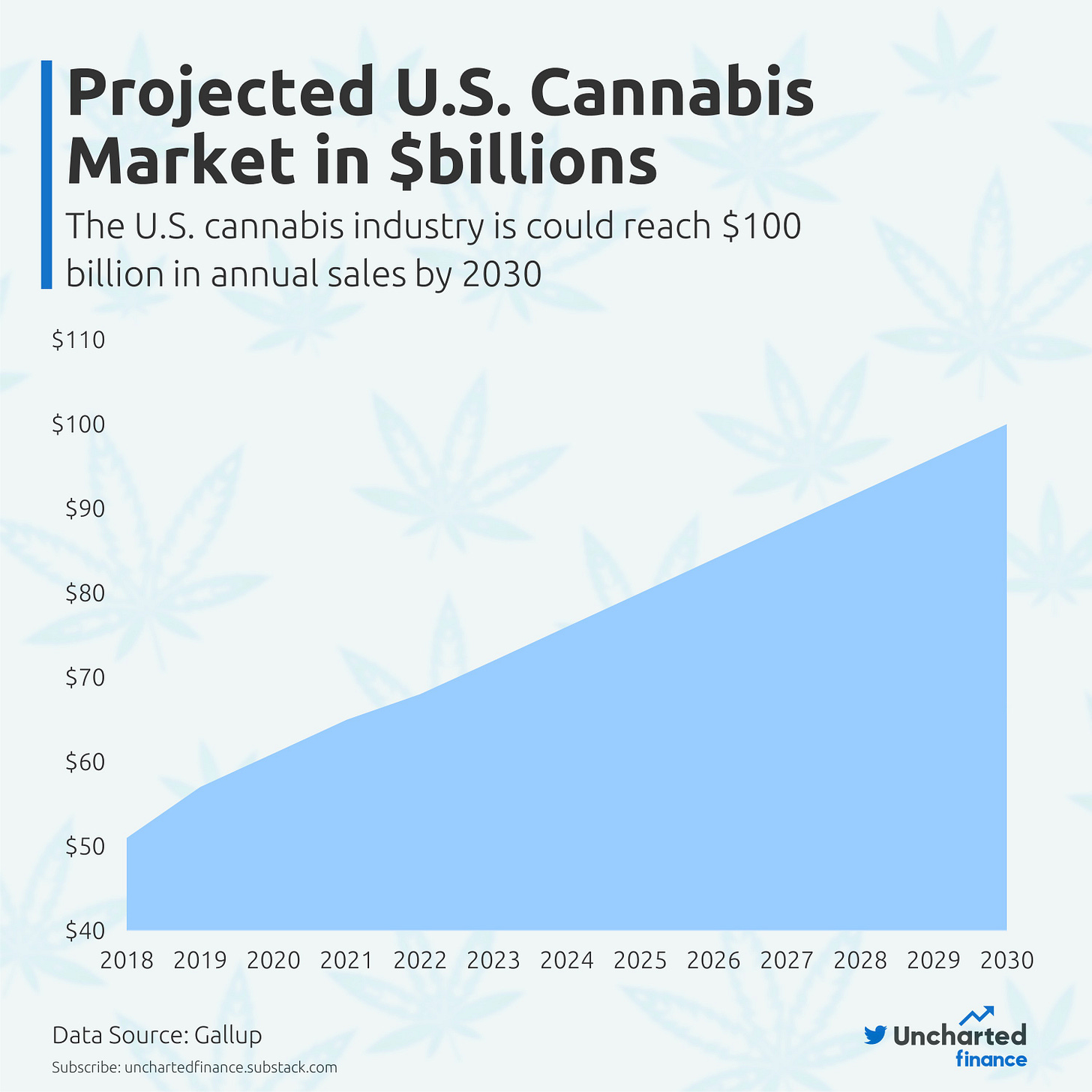

Marijuana Industry Outlook

Despite the challenges faced by the industry, such as federal restrictions and varying state laws, analysts remain optimistic about its future. With estimates suggesting that the legal marijuana market in the United States could reach a staggering $100 billion by 2030, the potential economic benefits are significant.

Catalysts to keep an eye on

More states say yes

According to Leafly, there are expectations this year that a number of US states will legalize the use of cannabis for adult-use or medical purposes. Delaware, Hawaii, Maryland, Minnesota, Ohio, Pennsylvania, and South Carolina are some of the states where legalization looks promising. The article outlines the status of cannabis legislation in each of these states, and the expectations and challenges they face.

On March 7, the majority of Oklahomans voted against recreational use of marijuana during a special election in the state. However, medical marijuana remains legal and has been widely available to residents for years.

Increased cannibalization

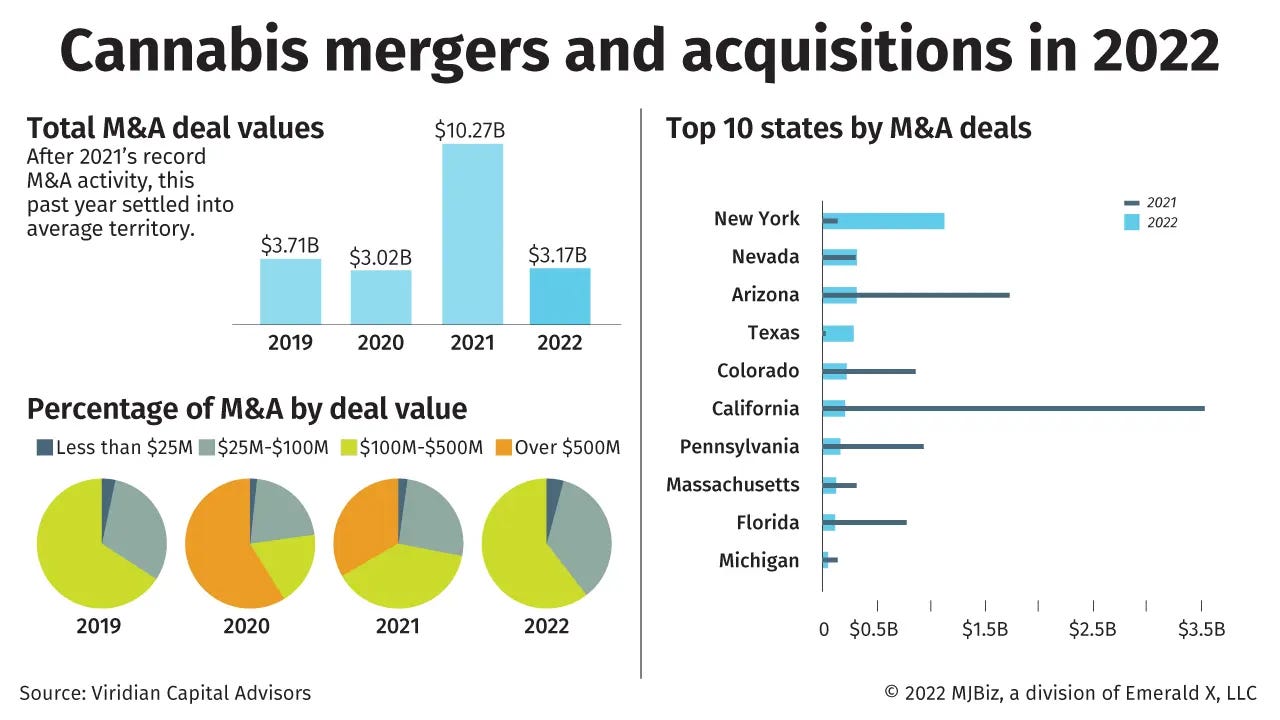

The cannabis industry is experiencing major consolidation in mature recreational markets due to falling prices, while younger markets have already reached a saturation point. Only the most cost-efficient players will survive and licenses will be absorbed by bigger, corporate-style businesses.

Access to financing

The revival of the SAFE Banking Act would reduce barriers for financial institutions to legally service marijuana businesses, opening more avenues to much-needed financing and provides a big boost to M&A.

Listing on Major Exchanges

If legal barriers are eliminated, listing financially strong marijuana companies on major exchanges can offer several advantages, such as:

Increased visibility and credibility: This can provide access to a larger pool of investors and improve liquidity, as major exchanges are typically more widely followed by investors.

Access to capital and regulatory oversight: Listing on major exchanges can help marijuana companies secure funding for growth initiatives and research & development, as well as ensure compliance with regulatory standards. This can support the long-term growth and success of the companies.

Investing in marijuana

Investing in the marijuana theme can be extremely volatile and unpredictable, requiring a strong stomach and a willingness to take risks. The market can fluctuate rapidly, and your investment could potentially disappear in the blink of an eye.

How to invest in the marijuana theme

When it comes to investing in the marijuana industry, investors have two main options: investing in individual marijuana stocks or investing in marijuana exchange-traded funds (ETFs). But first, it is important to assess the

Investing in U.S.-listed marijuana Stocks

Marijuana stocks are mostly listed on the OTC (Over-the-Counter) markets because marijuana is still illegal at the federal level in the United States, which limits the ability of these companies to list on major stock exchanges like the NYSE and NASDAQ. These major stock exchanges also have listing standards and rules that require companies to comply with federal laws, and since marijuana is still a Schedule I drug under the Controlled Substances Act, companies that deal with marijuana are not in compliance with federal law. Therefore, the major exchanges are reluctant to list these companies.

Why invest in marijuana stocks:

Growing industry with potential for significant growth

Increasing legalization and acceptance of marijuana use

Diversification of investment portfolio

Potential for high returns

Increasing number of companies going public

Why not to invest in marijuana stocks:

Regulatory risks and uncertainties

High volatility and unpredictable market fluctuations

Limited access to traditional banking services for cannabis companies

Lack of profitability for some companies in the industry

Stigma associated with marijuana use still exists in some parts of society

If you have the stomach for it , here is a list of marijuana stocks. Make sure to do proper due diligence.

Investing in U.S.-listed marijuana ETFs

Marijuana ETFs (Exchange-Traded Funds) are investment funds that are designed to track the performance of a basket of marijuana-related companies.

These ETFs hold a diversified portfolio of stocks in the marijuana industry, providing investors with exposure to the industry as a whole rather than just one specific company. This can significantly reduce risks.

The underlying holdings of marijuana ETFs typically include companies involved in various aspects of the marijuana industry, such as growers, cultivators, distributors, and retailers.

U.S. investors can buy the following Marijuana ETFs:

If you are new to ETF investing make sure to educate yourself. While ETFs are more diversified than individual stocks, they do carry risks. Visit ETF central guide page to learn more.

If you’re ready to buy a Marijuana ETF but not sure which one to pick, compare the following ETF characteristics:

Expense Ratio: The expense ratio is the annual fee charged by the ETF provider for managing the fund. It's important to compare expense ratios among different marijuana ETFs, as lower expense ratios can lead to higher returns (but not necessarily).

AUM: The AUM (Assets Under Management) of a marijuana ETF is the total value of assets held by the fund. It's important to compare the AUM of different marijuana ETFs because it provides an indication of the popularity and demand for the ETF among investors. A higher AUM generally indicates that more investors are interested in the fund, which can be a positive sign for its future performance. It can also indicate that the ETF provider has more resources available to manage the fund effectively.

Holdings: Each marijuana ETF has a different portfolio of underlying holdings. Some ETFs may have more exposure to growers and cultivators, while others may focus more on retailers and distributors. It's important to consider the holdings of each ETF to ensure they align with your investment objectives. Go to the fund’s page and view its holdings.

Performance: You should review the historical performance of each ETF to determine if they have consistently performed well over time. Keep in mind that past performance does not guarantee future results. You can compare Marijuana ETFs performance with Investing.com or Yahoo Finance comparison feature.

Diversification: Diversification is important to reduce risk. Check if the ETF offers broad exposure to the marijuana industry or if it's focused on a specific niche within the industry.

Liquidity: The liquidity of the ETF is important as it affects the ease of buying and selling shares. ETFs with higher trading volumes tend to have tighter bid-ask spreads, making it easier to buy or sell shares.

Tax Implications: Finally, consider the tax implications of investing in marijuana ETFs. Capital gains and dividends received from marijuana ETFs are taxed at different rates, and investors should consult with a tax professional to understand the tax implications of investing in marijuana ETFs.

DISCLAIMER: The information provided on this blog is for informational purposes only and should not be considered financial advice. The content on this blog is not intended to be a substitute for professional financial advice, and we recommend that you seek the advice of a qualified financial advisor before making any investment decisions. We do not guarantee the accuracy, completeness, or reliability of the information on this blog, and we will not be held responsible for any errors or omissions or any actions taken based on the information provided. The views and opinions expressed on this blog are those of the authors and do not necessarily reflect the official policies or positions of any company or organization.