Charting Gold | Discover the golden opportunity with visualized data on the latest trends and strategies for investing in gold markets

Covering the factors that drive gold prices and the different ways to invest in gold.

Gold is a valuable precious metal that has been used as a form of currency and as a store of value for thousands of years. As an investment, gold can provide diversification and protection against inflation and economic downturns. Gold prices tend to increase during times of economic uncertainty and can act as a hedge against stock market volatility.

Did you know?

Fact #1: People love gold!

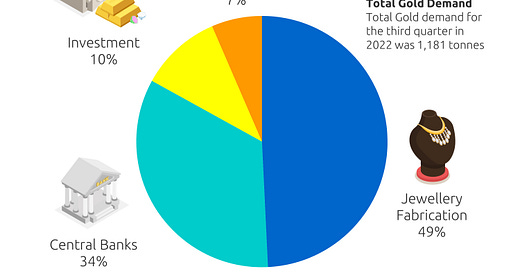

The majority of the demand for gold still comes from the jewelry industry, with a significant portion of gold mined and purchased for making jewelry, mainly in the Asia-Pacific region. This consistent demand for gold in jewelry helps to stabilize the gold market and can provide an additional source of demand during times when other sectors may be experiencing a slowdown. Additionally, the cultural significance of gold in certain regions also plays a role in maintaining the demand for gold in jewelry.

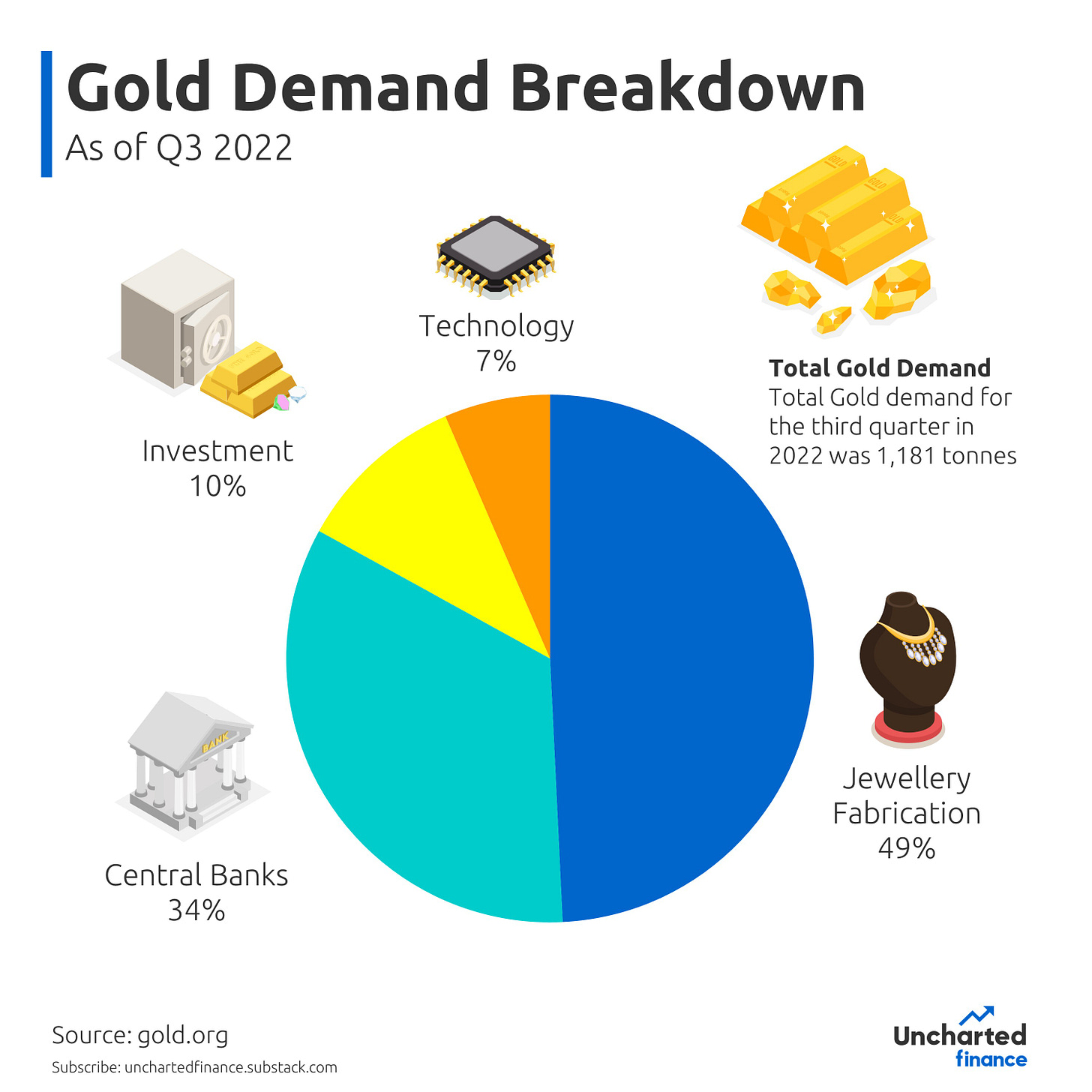

Fact #2: The Biggest Gold Mining Companies are based in North America

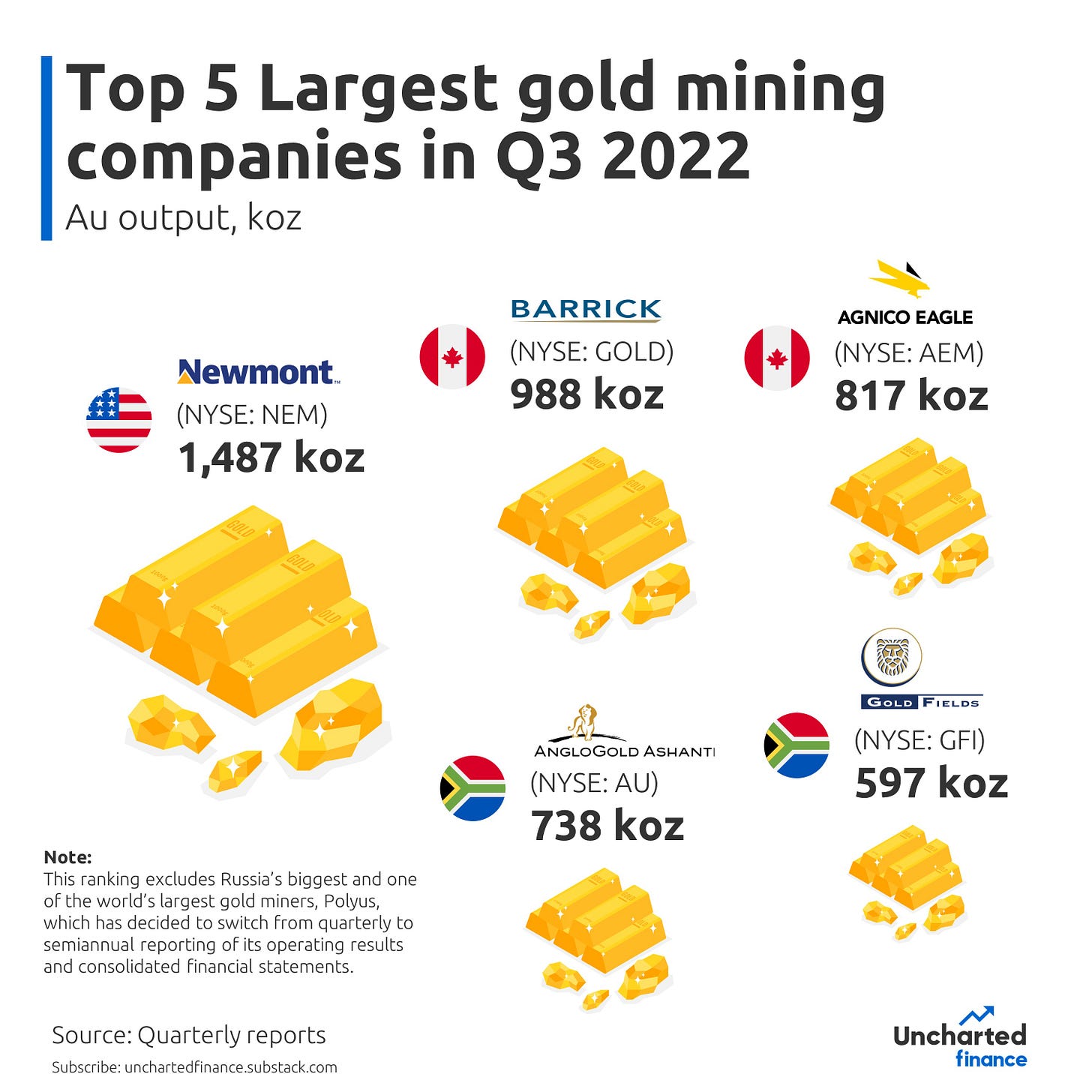

Fact #3: And…This is why!

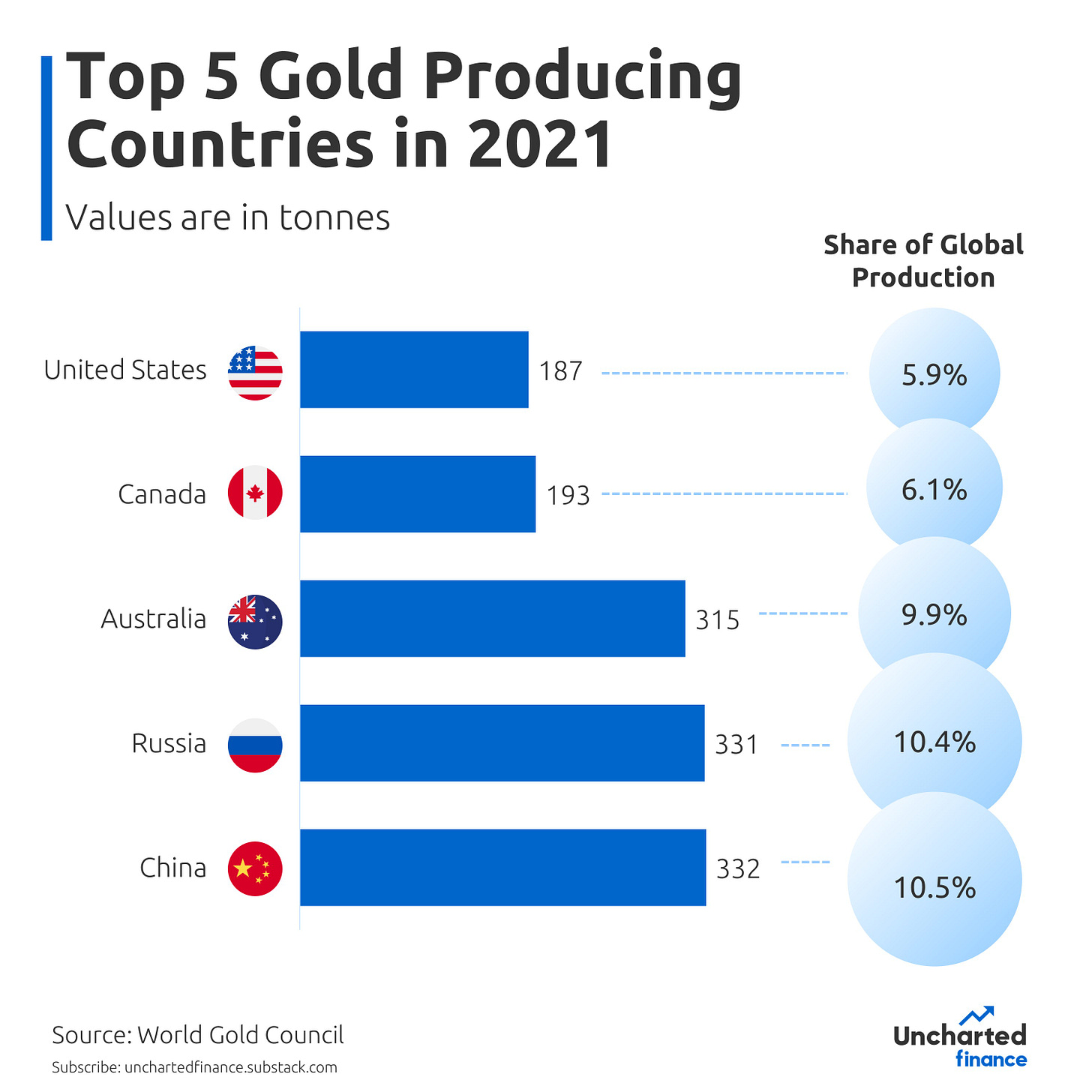

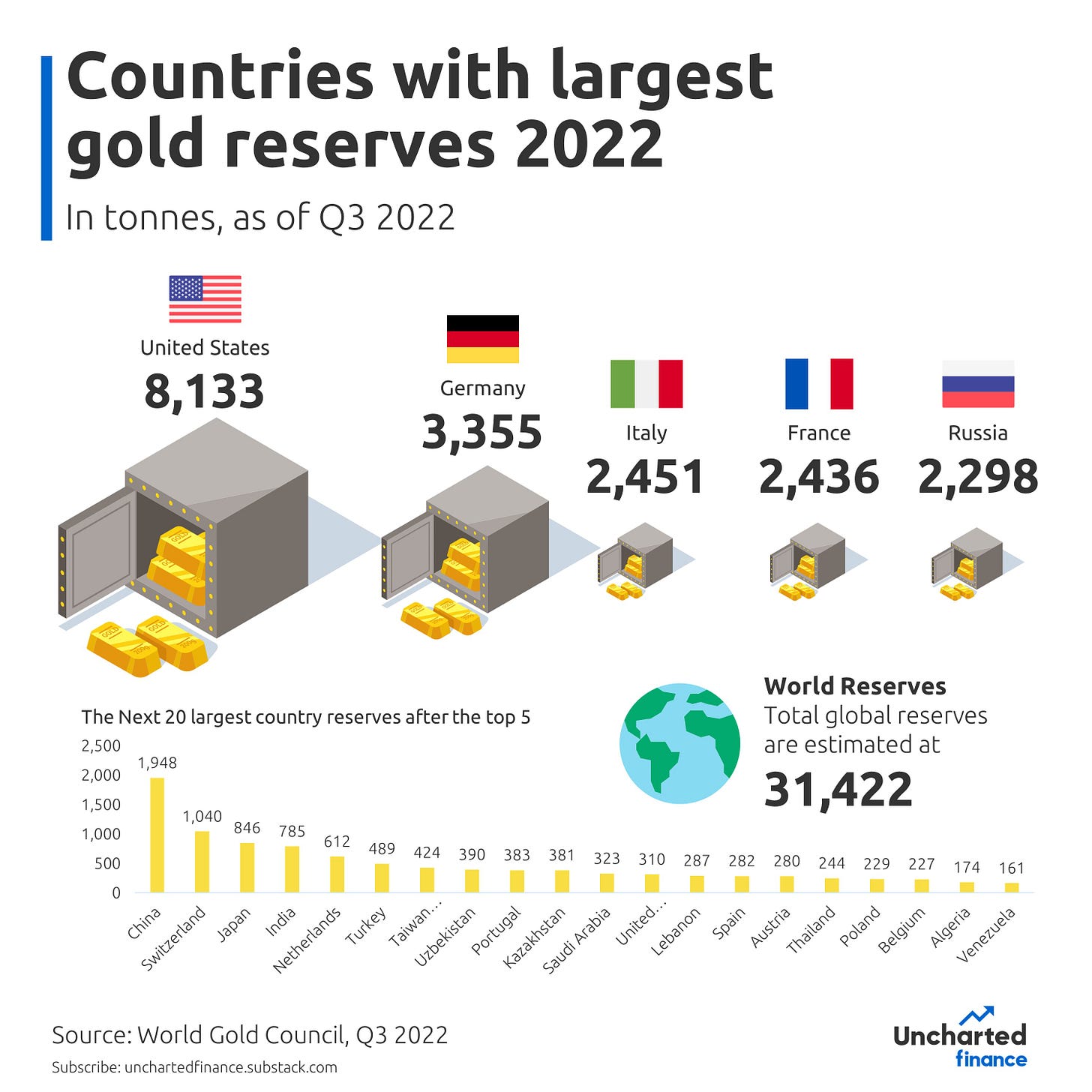

Fact #4: Apparently, Central Banks love Gold too!

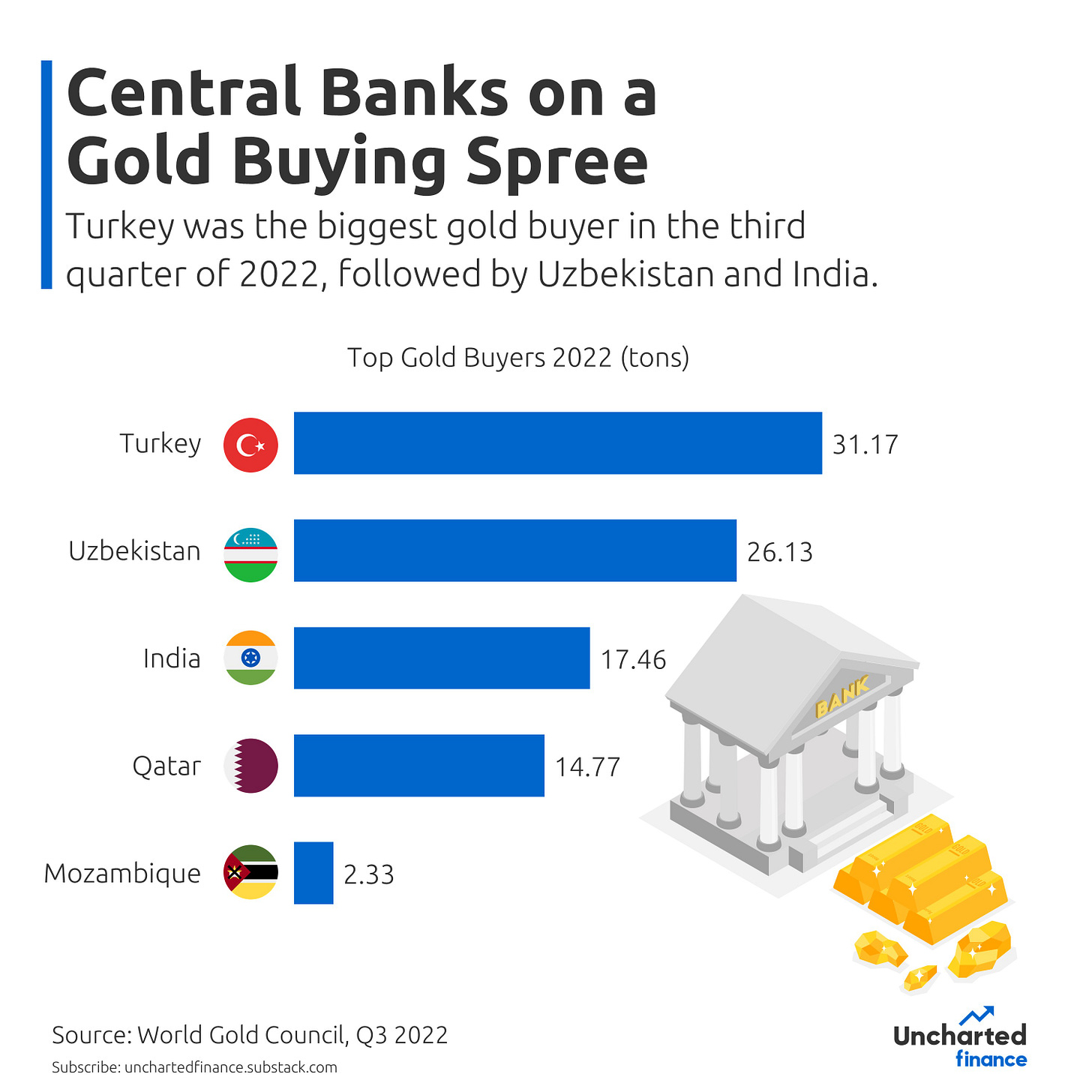

Fact #5: Some Central Banks have been piling up on Gold lately!

Central banks have been stockpiling gold amid rising inflation, devaluating currencies and economic uncertainties.

Gold Performance

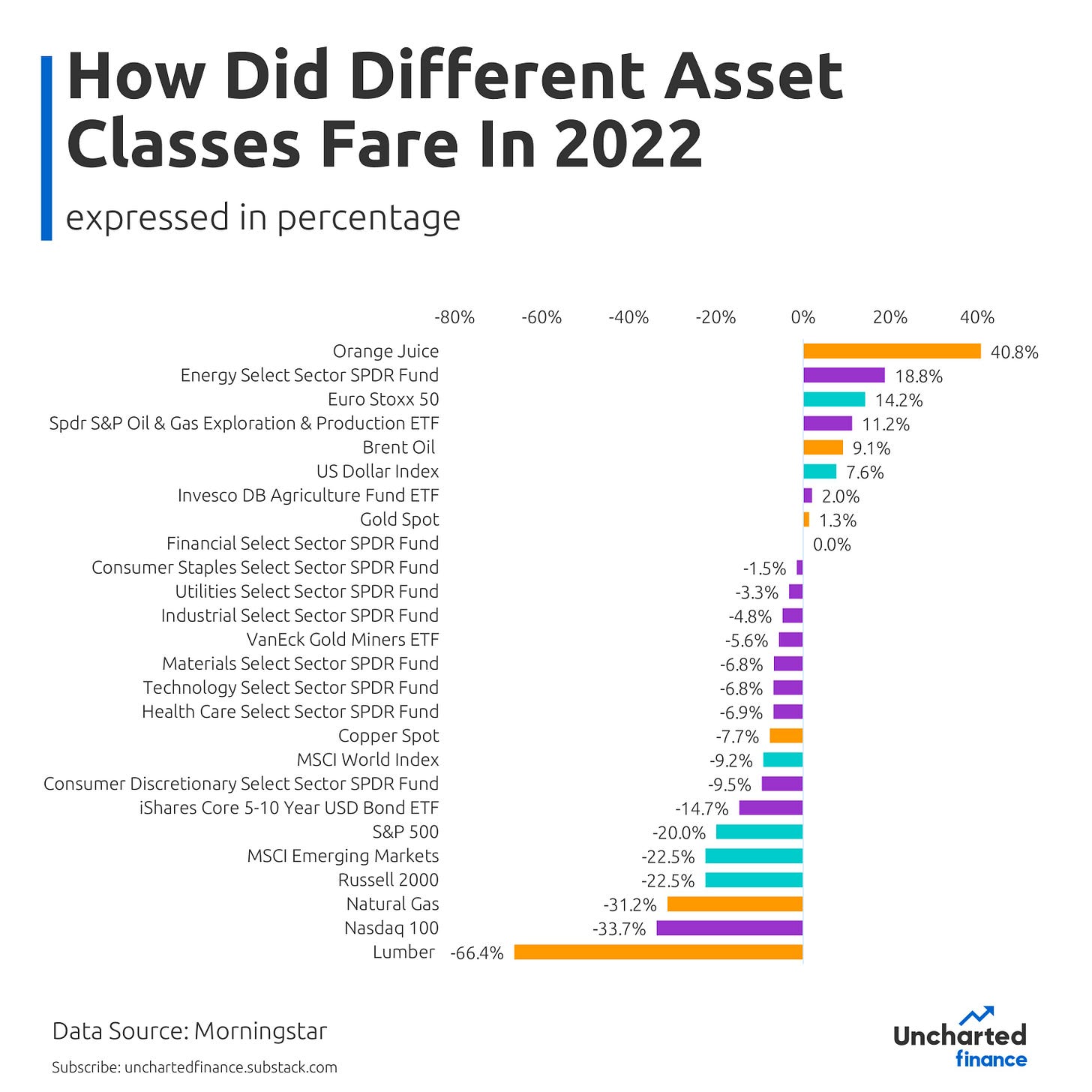

How did Gold fare in 2022

Gold Performance vs. different asset classes

What drives Gold Prices

Gold is often sought after as a safe investment during times of economic uncertainty, such as during a recession or when major geopolitical tensions are present. Additionally, the price of gold can be affected by various factors, including changes in interest rates, shifts in supply and demand, changes in mining costs, and overall economic conditions.

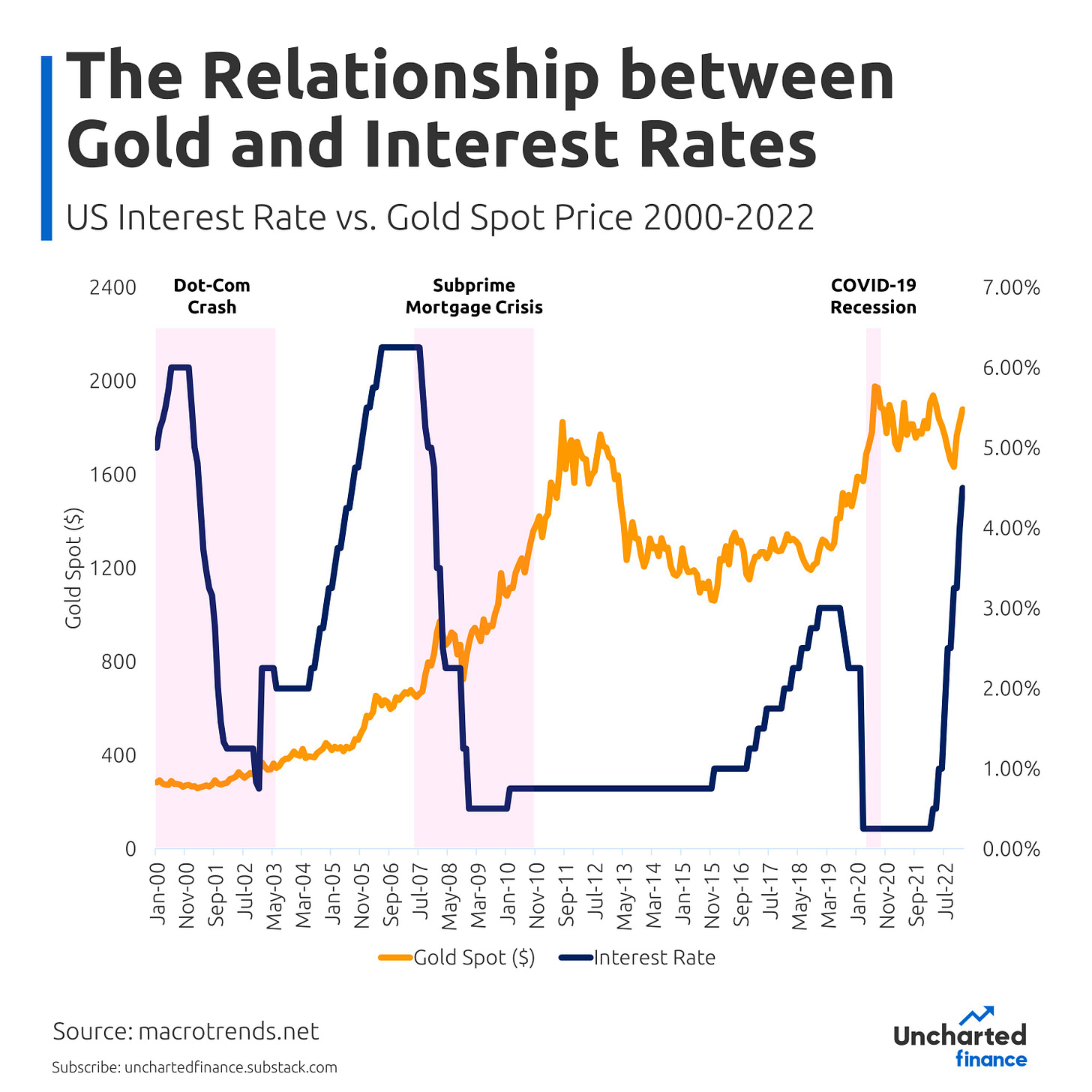

Interest Rate

When interest rates are low, it provides access to inexpensive borrowing, which can be used to fuel economic activities. In this scenario, investors may have a wider range of investment options that have the potential to yield higher returns. As a result, gold may not be considered a top choice for investment during this period. However, during a recession, the appeal of gold as a safe-haven investment increases as it is less affected by changes in economic conditions than other investments.

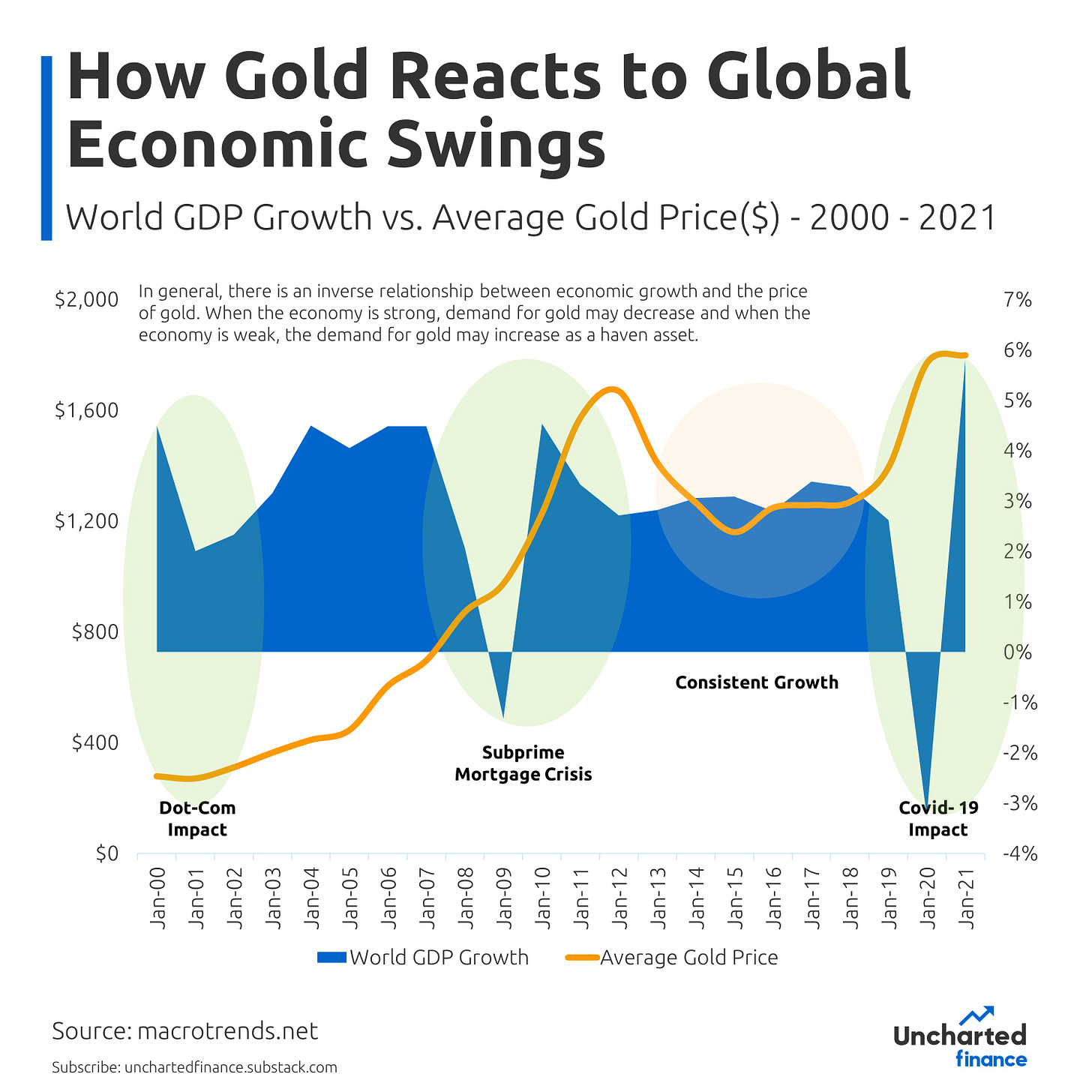

Economic Condition

During slowdowns or economic recessions, investors often turn to gold as a safe investment option due to the limited investment opportunities available.

During prolonged recessions, gold experiences a prolonged upward trend, known as a "bull market," as investors turn to it as a safe haven. As the recession lasts longer, the bull market for gold also lasts longer.

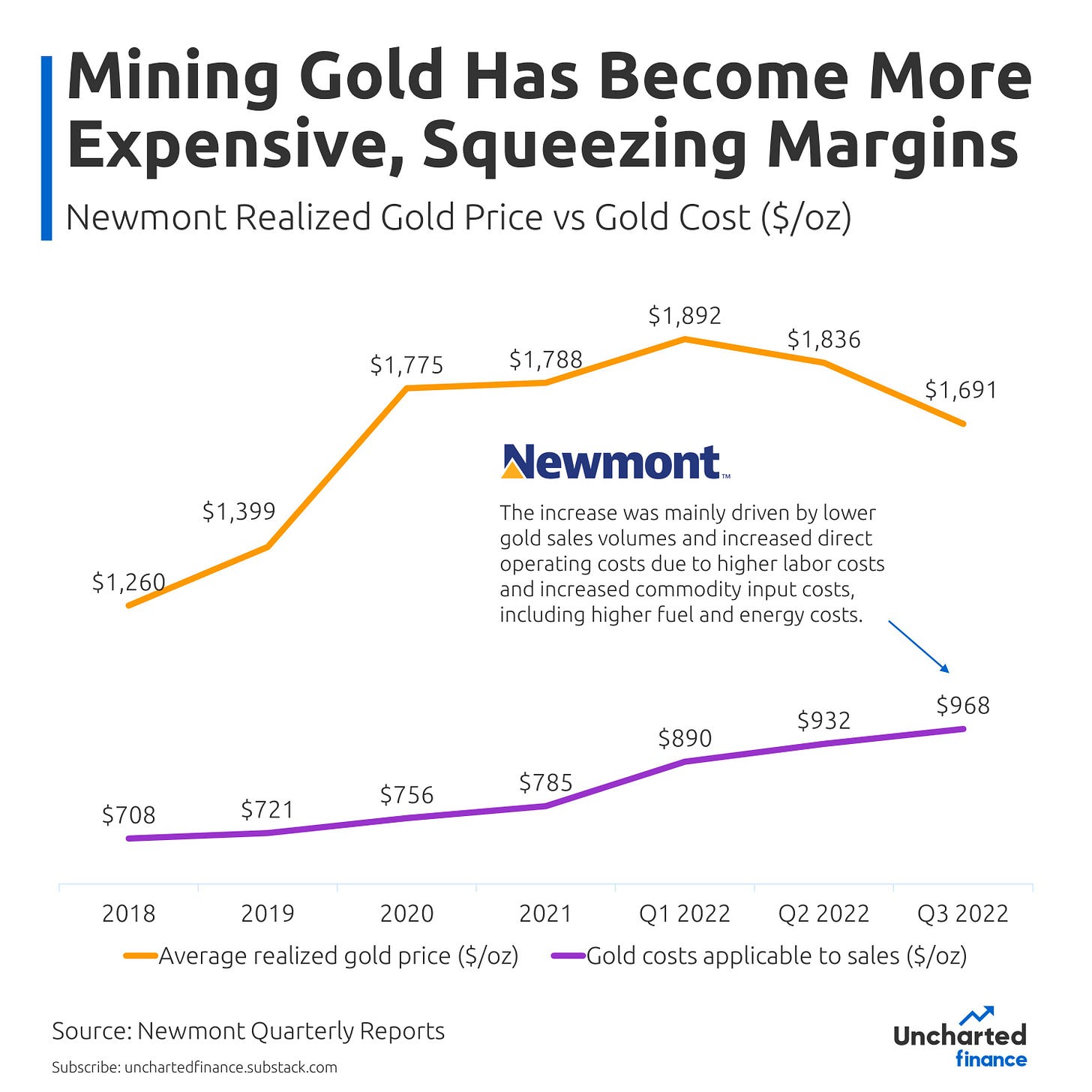

Higher Mining Costs

The cost of mining gold has risen significantly due to inflation, particularly in 2022. According to data from Newmont, the cost of gold sold increased by 23.3% in Q3 2022 compared to the previous fiscal year

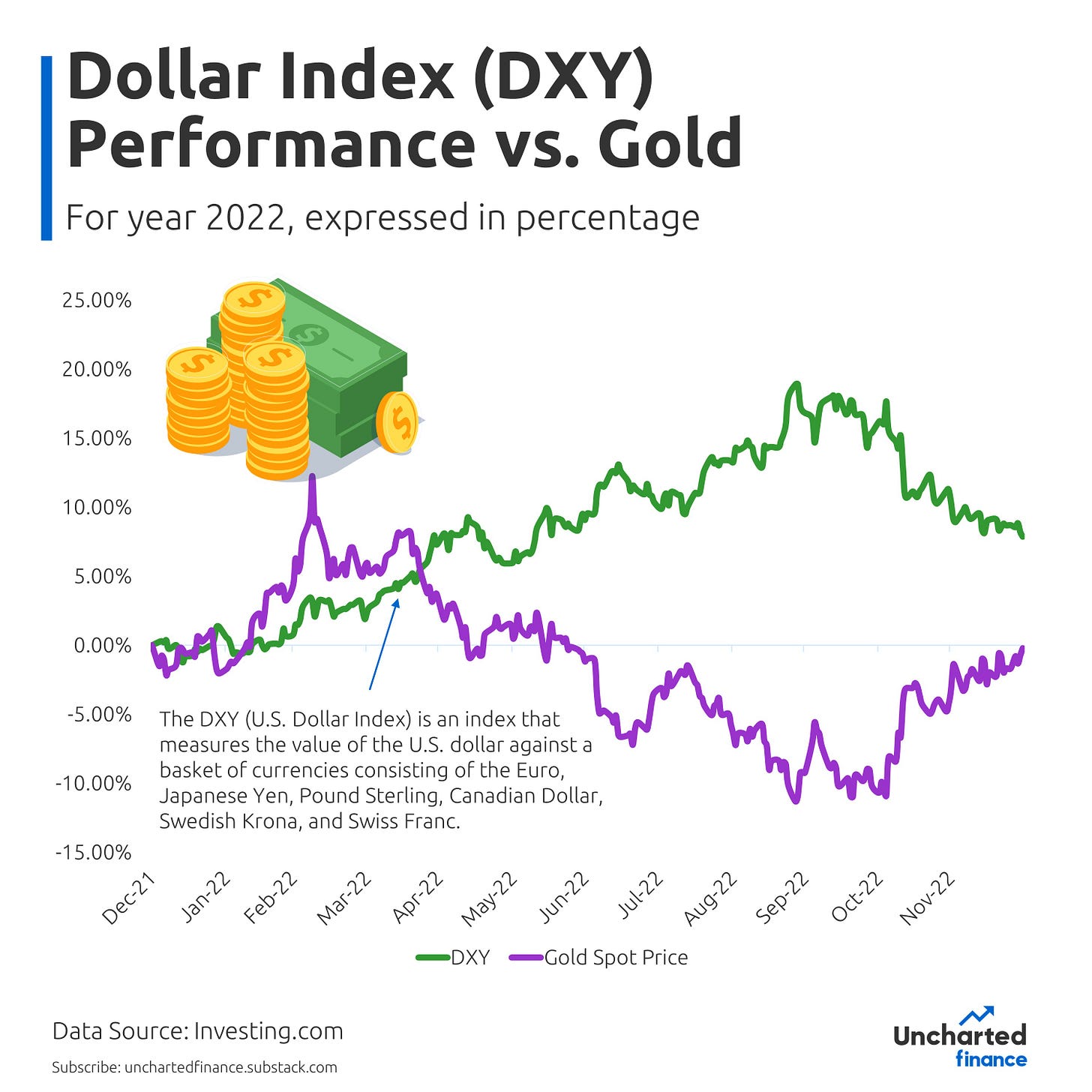

Dollar Strength

The inverse relationship between gold prices and the dollar can be observed when looking at historical data. Generally, when the US. Dollar Index (DXY) rises, gold prices fall, and vice versa. This is because when the dollar is strong, it tends to make gold more expensive for buyers using other currencies, which can decrease demand and push prices lower. Conversely, when the dollar is weak, it tends to make gold cheaper for buyers using other currencies, which can increase demand and push prices higher.

The chart below clearly illustrates that inverse relationship

How to Invest in Gold

Buy Physical Gold

The advantage

This can be in the form of coins, bars, or jewellery. The advantage of this approach is that you have actual gold that you can hold onto.

The disadvantage

Gold is difficult to store and transport and may not be practical for large investments.

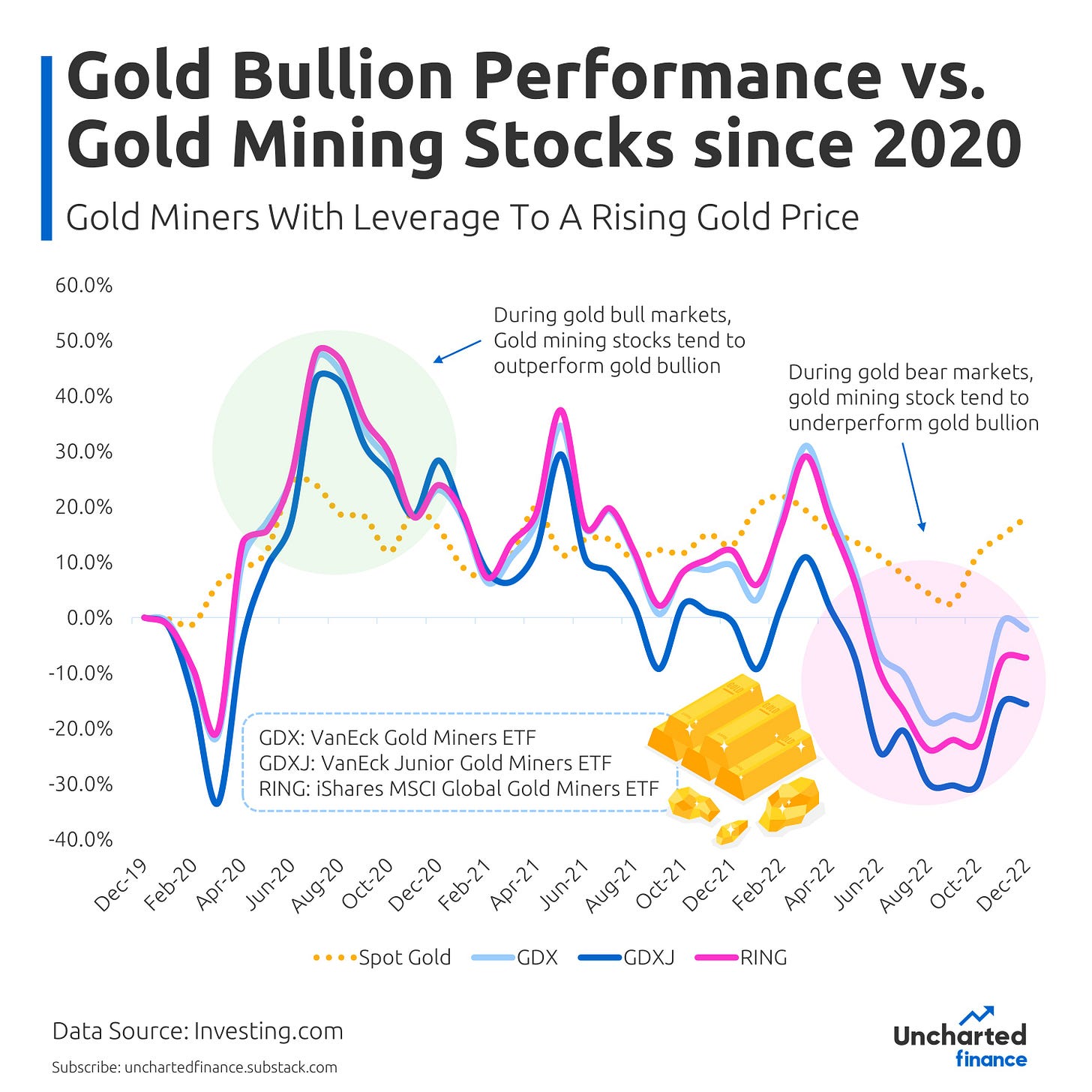

Buy Gold Mining Stocks

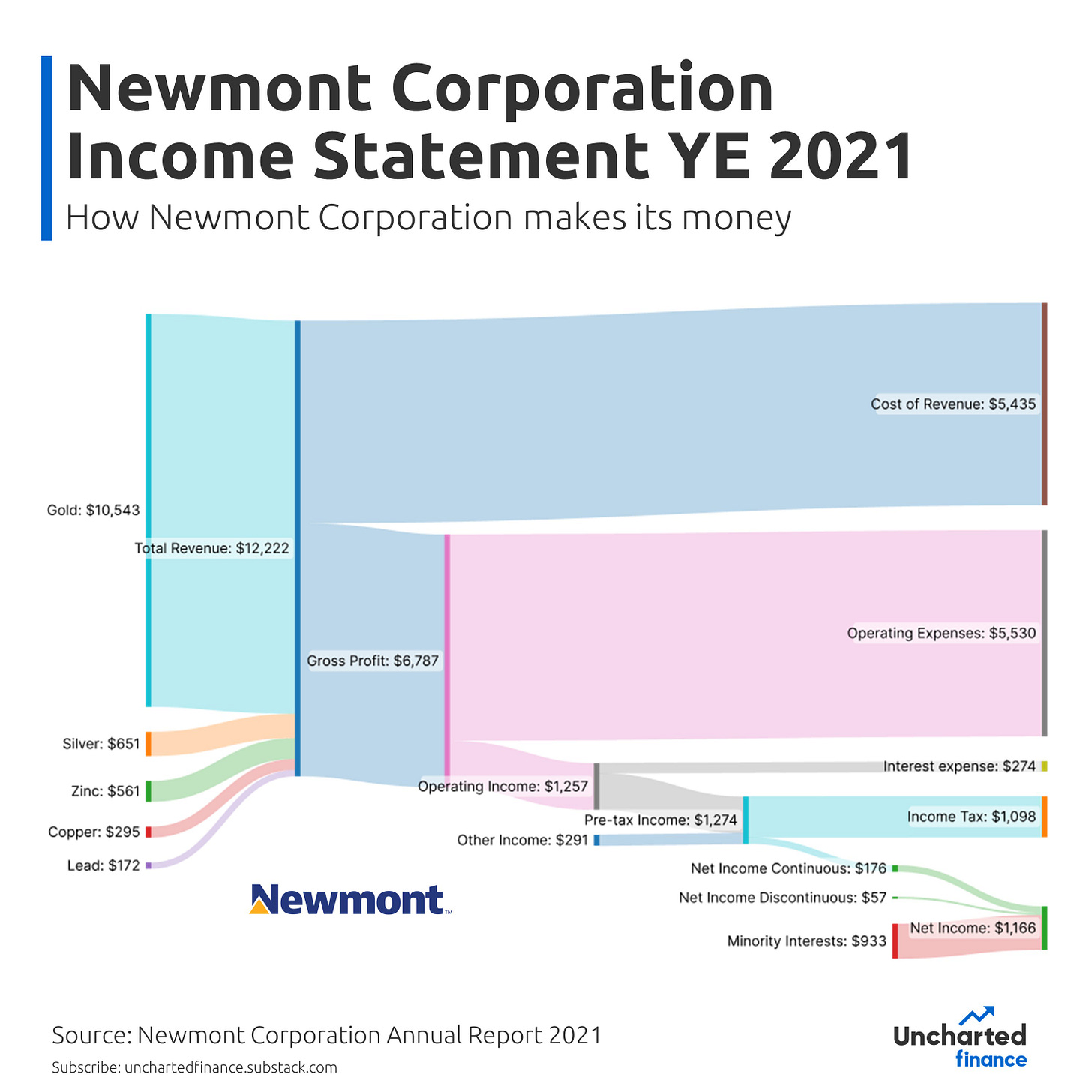

Gold mining stocks are another option to consider as an investor. You can buy shares in gold mining companies, which gives you exposure to the price of gold through the performance of the company.

Chart: Top 10 largest gold mining companies

Key mechanism to consider: Operating leverage

Buying gold mining stocks may be a volatile option, as the stock price of the mining company may not necessarily move in line with the price of gold. This is due to operating leverage.

What is operating leverage?

A company with high operating leverage has a relatively large proportion of fixed costs, which means that a small change in the price of gold can have a disproportionately large impact on the company's profits.

For example, if a gold mining company has a lot of fixed costs and the price of gold increases, its profits will also increase significantly because the increase in revenue from selling more gold will more than offset the fixed costs. On the other hand, if the price of gold falls, the company's profits will fall significantly because the decrease in revenue will not be fully offset by the fixed costs.

What does it mean for investors?

High operating leverage can be both a blessing and a curse for a gold mining company. It can lead to higher profits when the price of gold is rising, but it can also lead to significant losses when the price falls. As a result, companies with high operating leverage may be more risky investments, as they are more sensitive to changes in the price of gold.

Invest in Gold ETFs

What are ETFs

An ETF, or exchange-traded fund, is a type of investment vehicle that tracks the performance of a particular market index or asset class. ETFs are traded on stock exchanges and can be bought and sold in a similar way to stocks. They offer investors the benefits of diversification, low costs, and flexibility, as they can be bought and sold throughout the trading day and can be easily bought and sold through a brokerage account.

What are Gold ETFs

Gold ETFs, or exchange-traded funds, are investment vehicles that track the price of gold. They can be bought and sold on stock exchanges and provide investors with exposure to the gold market without the need to physically own the metal.

There are several types of gold ETFs available, including those that track the price of gold bullion, those that invest in gold mining stocks, and those that use futures contracts or other derivatives to gain exposure to the gold market.

Physical Gold ETF

A physical gold ETF is a type of exchange-traded fund (ETF) that tracks the price of gold by physically holding gold bullion in a vault. This means that when you invest in a physical gold ETF, you are buying an ownership interest in a specific amount of gold. The value of your investment will be based on the price of gold, minus any fees or expenses associated with the ETF.

Synthetic Gold ETF

A synthetic gold ETF is a type of exchange-traded fund (ETF) that tracks the price of gold using derivatives, such as futures contracts or options, rather than physically holding gold bullion. These ETFs aim to replicate the performance of gold, but they do not physically hold the metal.

Gold Mining Stocks ETFs

Gold mining stock ETFs are exchange-traded funds (ETFs) that invest in Gold mining companies that are involved in the exploration, extraction, and production of gold. These ETFs provide investors with exposure to the gold market through the performance of gold mining companies, rather than through the price of gold itself.

Are you interested in Gold ETFs? See list of all Gold ETFs

DISCLAIMER: The information provided on this blog is for informational purposes only and should not be considered financial advice. The content on this blog is not intended to be a substitute for professional financial advice, and we recommend that you seek the advice of a qualified financial advisor before making any investment decisions. We do not guarantee the accuracy, completeness, or reliability of the information on this blog, and we will not be held responsible for any errors or omissions or any actions taken based on the information provided. The views and opinions expressed on this blog are those of the authors and do not necessarily reflect the official policies or positions of any company or organization.