Charting Tesla | A Look at the Numbers Behind the Long-tenured Hype

Examining Tesla's FY 2022 Results and latest updates

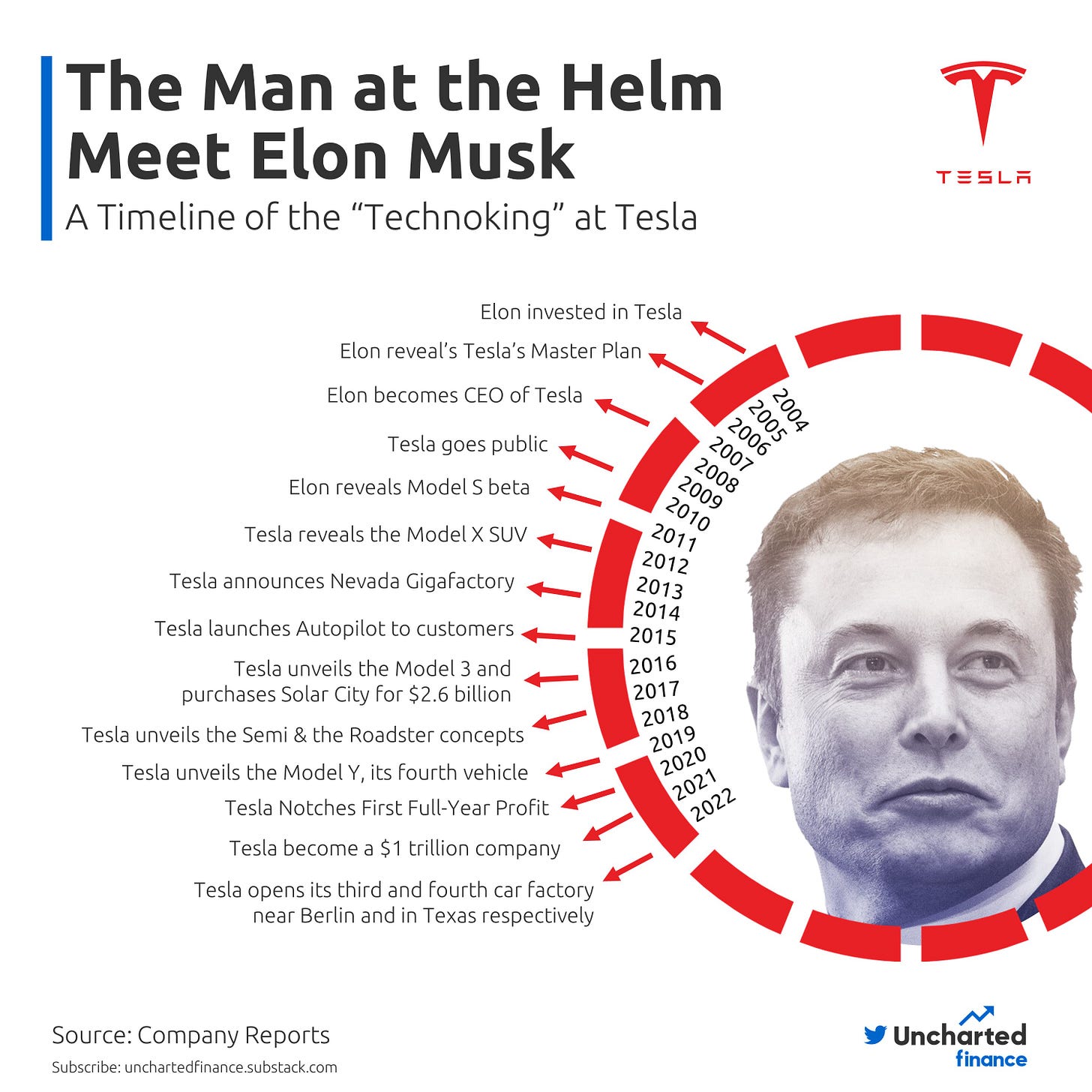

As the FY 2022 Earnings Season unfolds, we examine the exceptional performance of Tesla, delving into the leadership and vision of its CEO, the "Technoking" Elon Musk, responsible for the company's success.

First Things First: Tesla’s FY 2022 Results

On January 25th, 2022 Market Close, Tesla (TSLA) released its financial results and shareholders letter for the fourth quarter and full-year 2022. Here are the main takeaways.

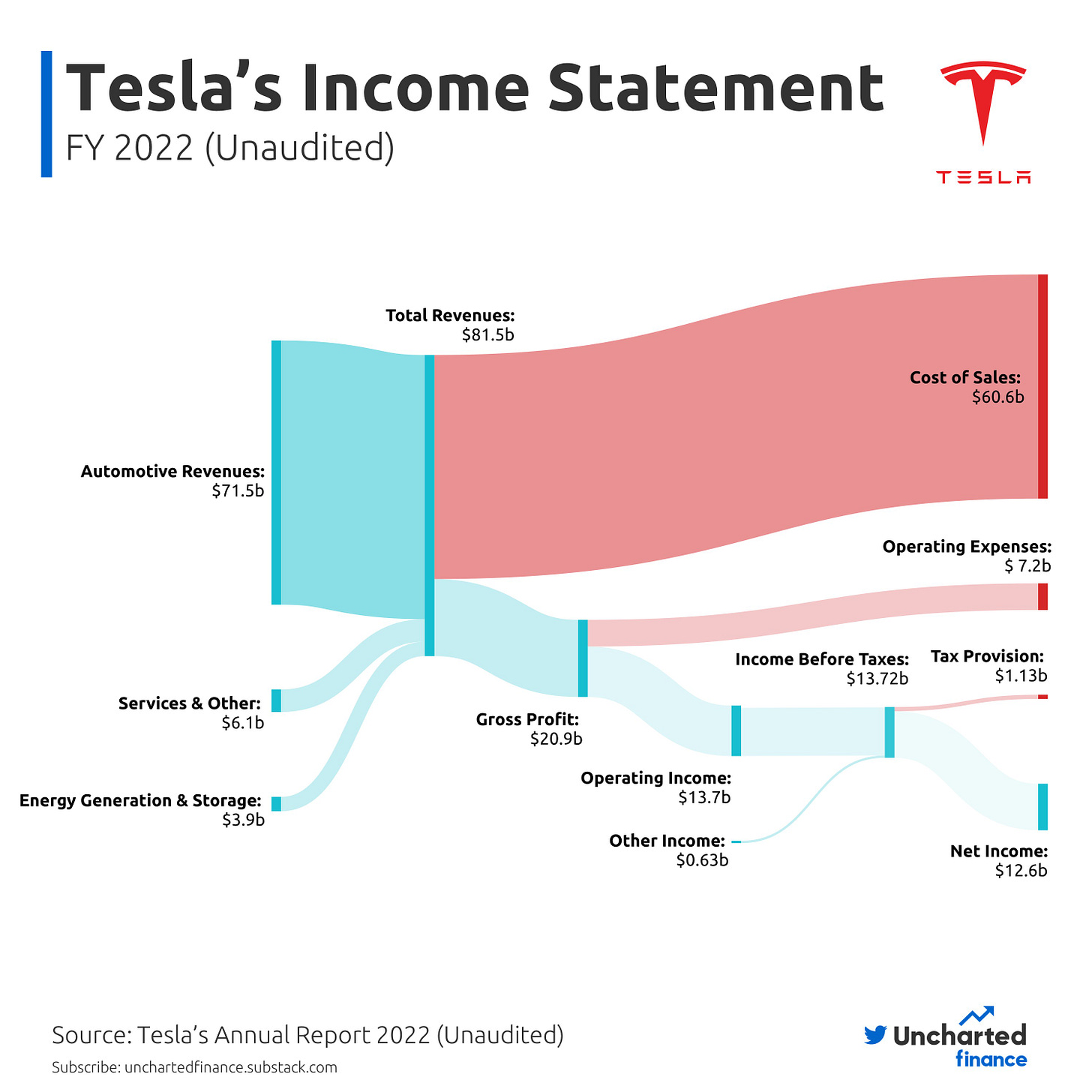

FY 2022 Income Statement

Tesla reported mixed fourth-quarter results, topping earnings estimates while missing on revenue views

Tesla stock rose 8.6% after hours, shares edged up 0.4% to 144.47 during Wednesday's market trade

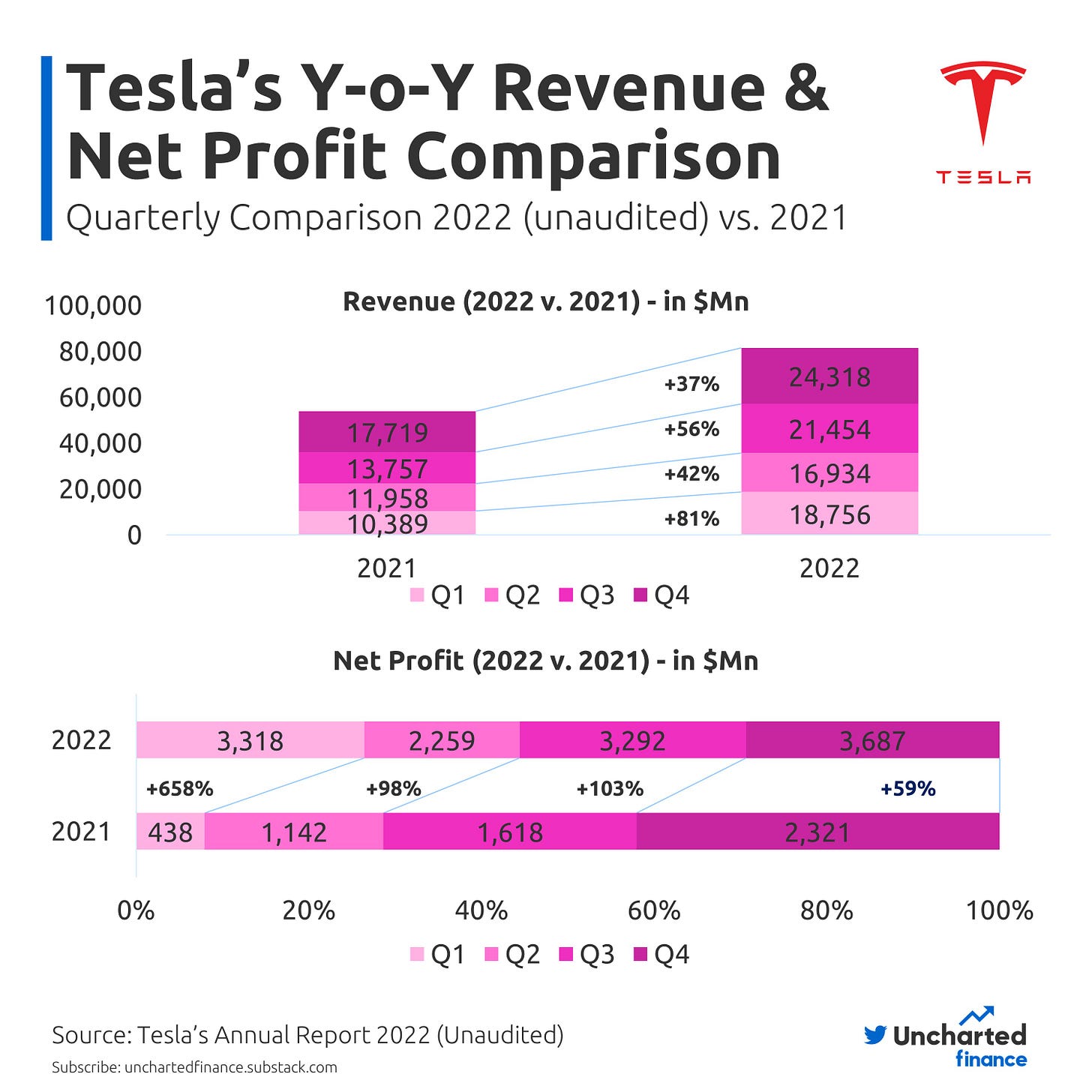

Tesla's EPS advanced 40% to $1.19 while revenue grew 37% to $24.32 billion in Q4.

For the full year, revenue increased 51% to $81.46 billion

Earnings ballooned 80% to $4.07 per share, topping Wall Street expectations.

The company managed to increase its cash position by just over $1 billion during the quarter and it now sits on an impressive $22 billion pile of cash.

Tesla stock soared in overnight trade after CEO Elon Musk was bullish about 2023.

Automotive Sales

Tesla's deliveries hit a record 405,278 in the fourth quarter, missed lowered forecasts despite aggressive year-end incentives.

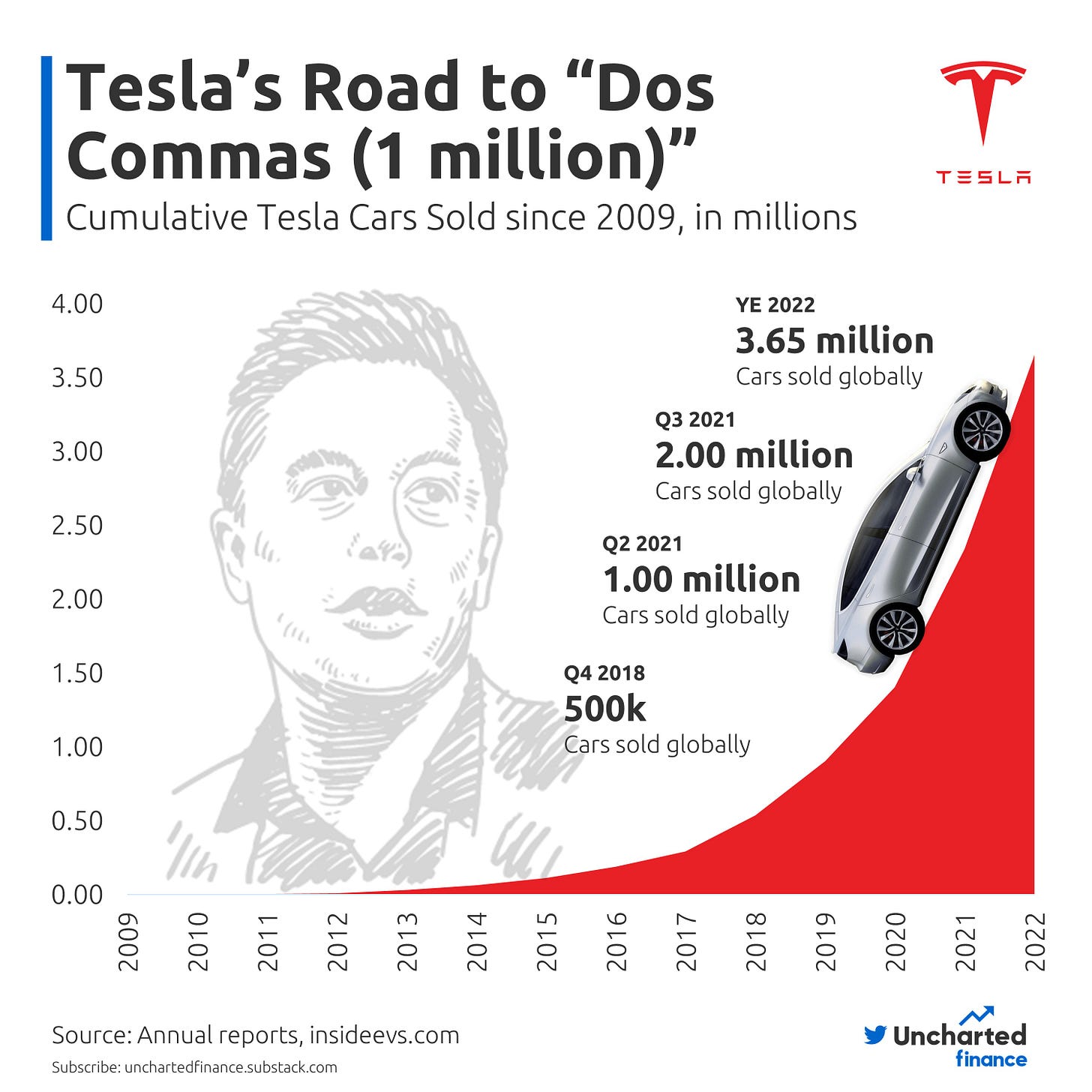

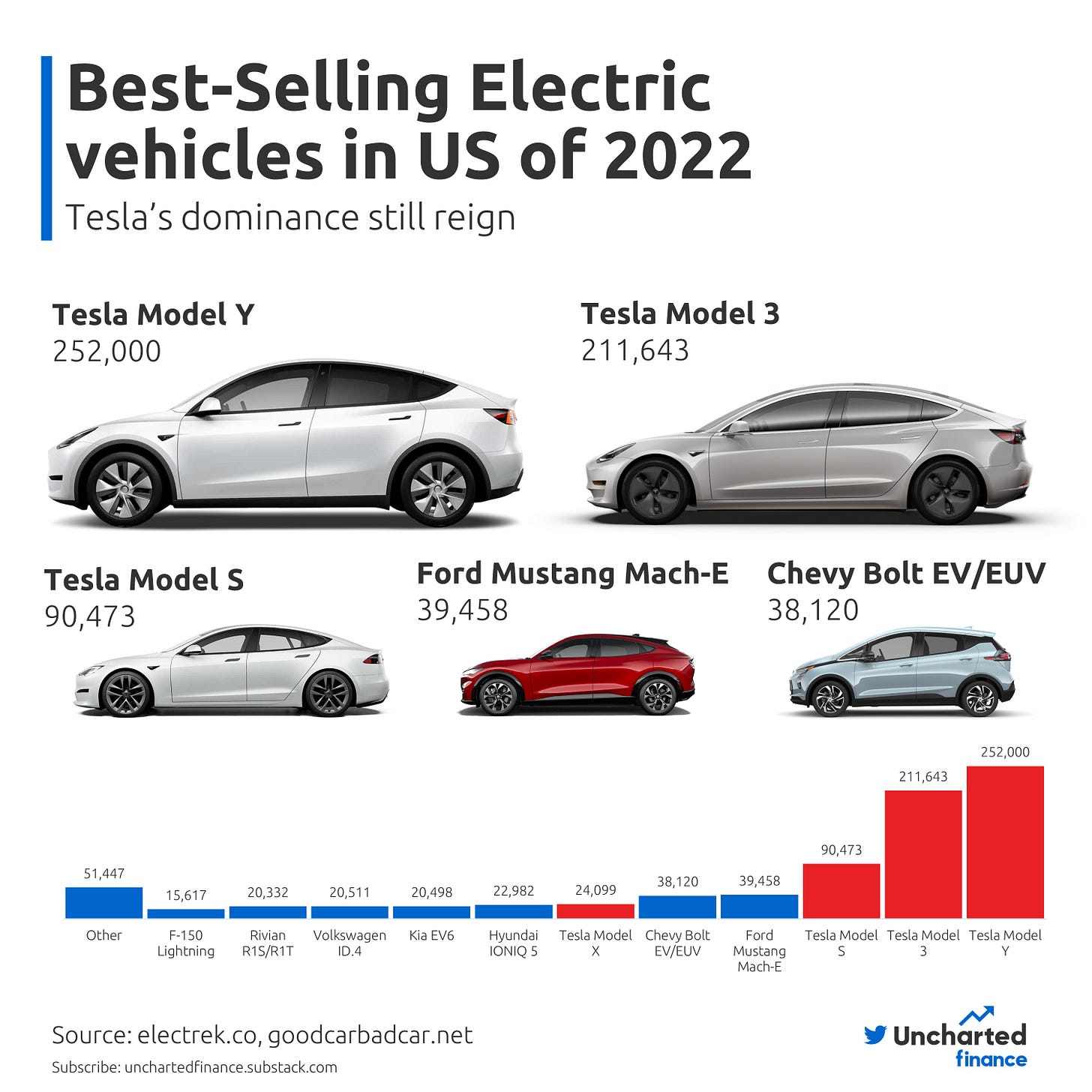

Tesla unit sales came in at 1,313,851 for 2022, up 40% vs. 2021 but below the 50% target. The Model 3 sedan and Model Y crossover accounted for the vast majority of sales. The high-end Model S and X vehicles accounted for the rest.

For 2023, Tesla said it expects to produce around 1.8 million vehicles, an increase of 37% compared to 2022. But CEO Elon Musk said internally Tesla is looking to make 2 million EVs.

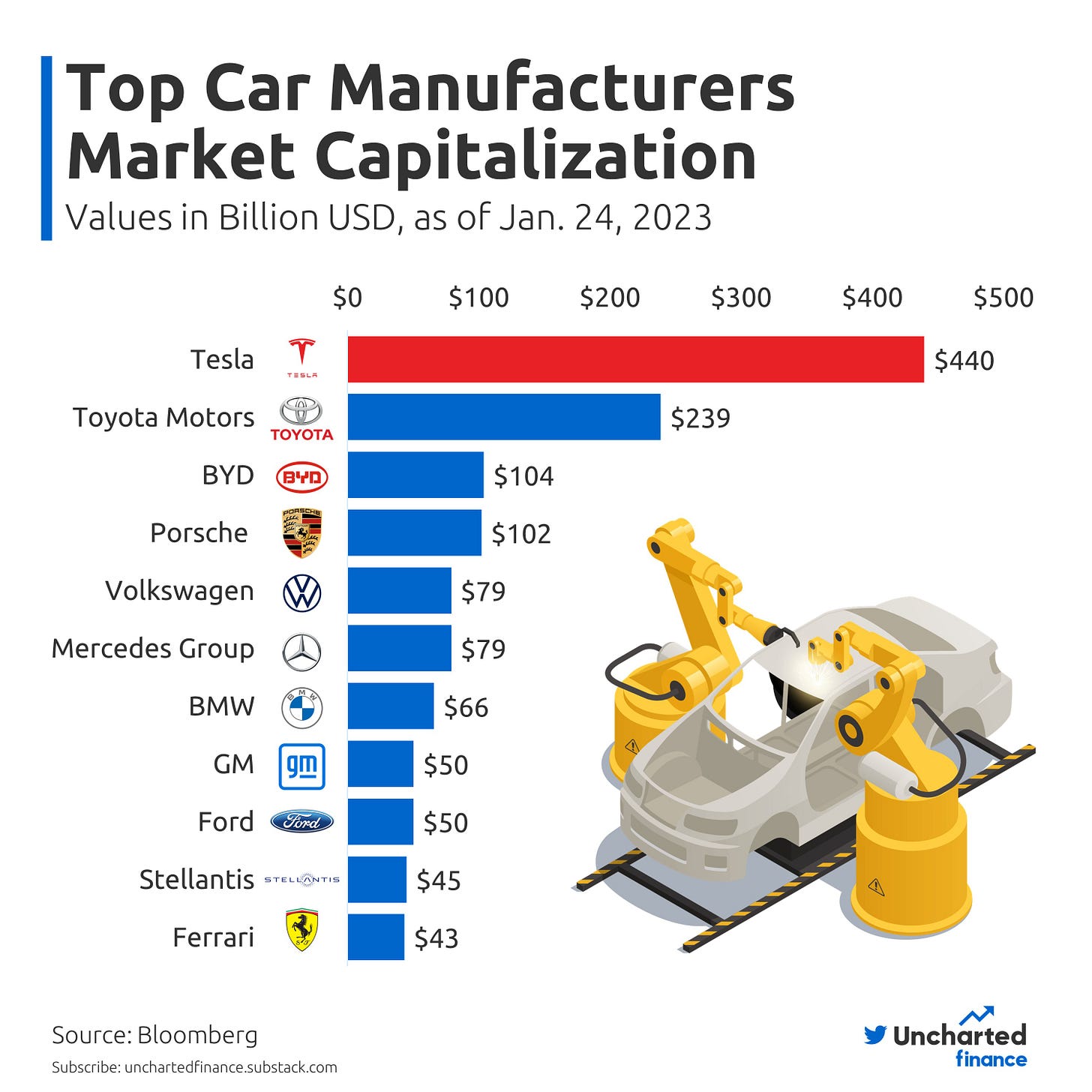

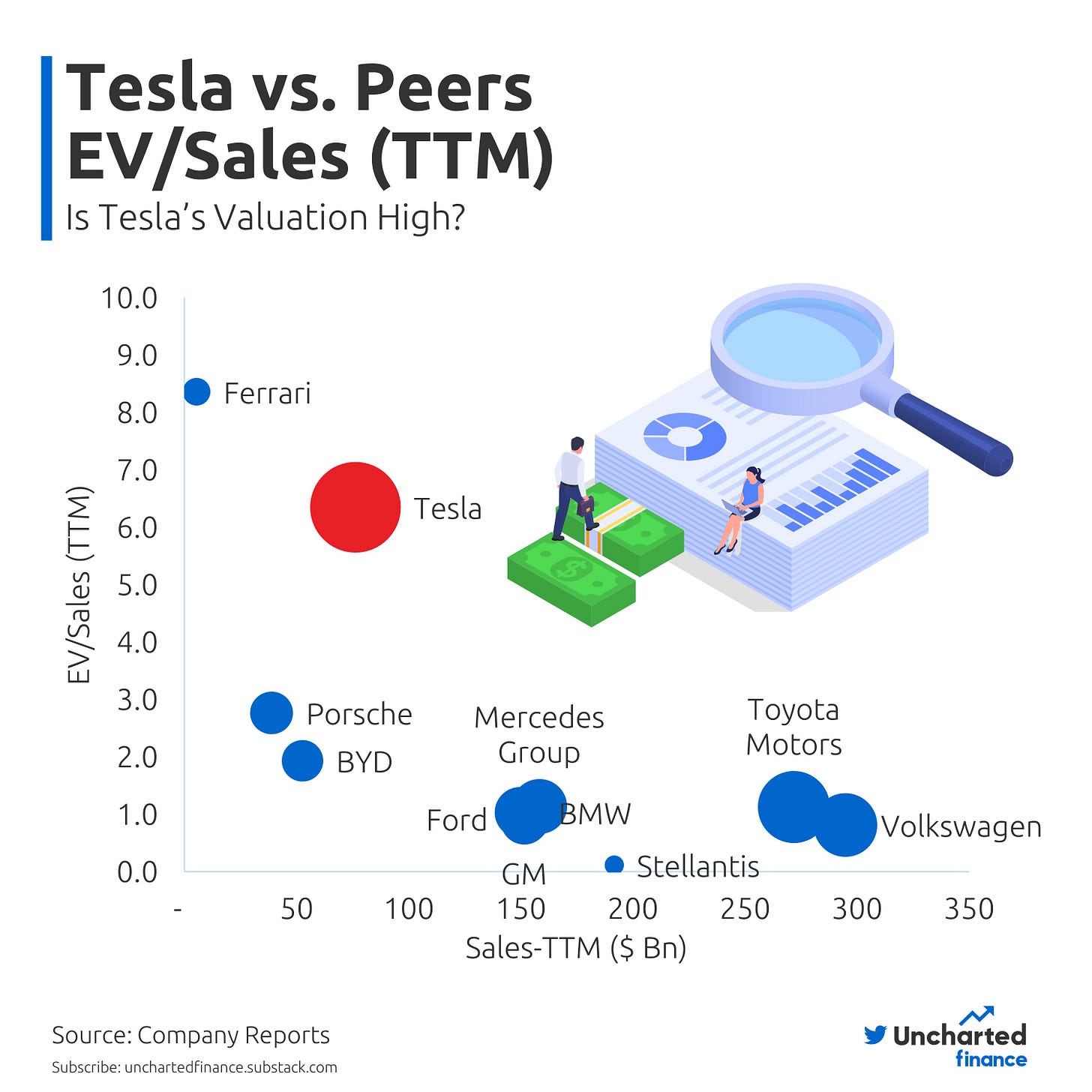

Tesla vs. Peers

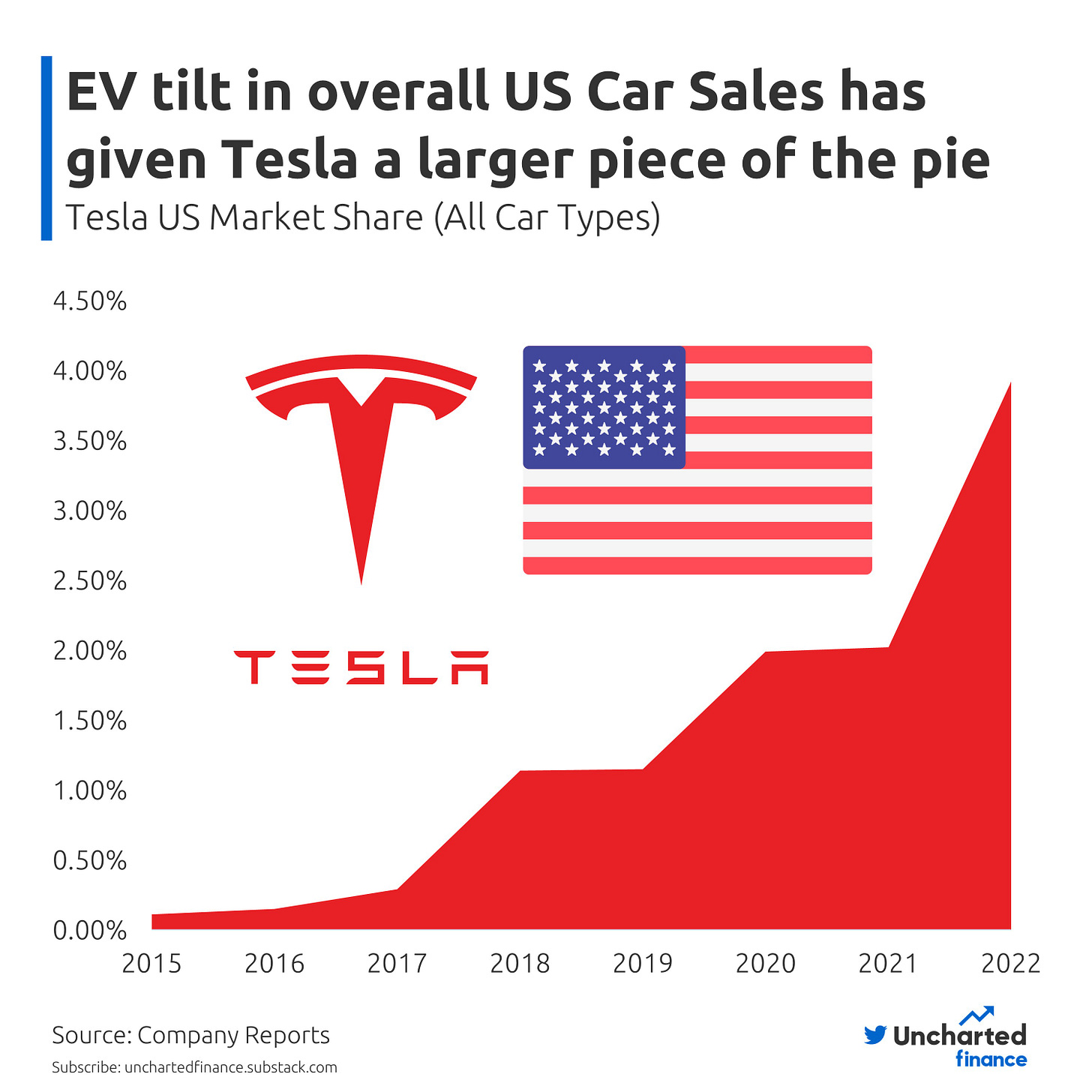

EV Adoption in the U.S. and the popularity of Tesla cars have increased the company’s overall U.S. market share

Tesla Models rank among the top-selling EV cars in the US, but other brands are catching up!

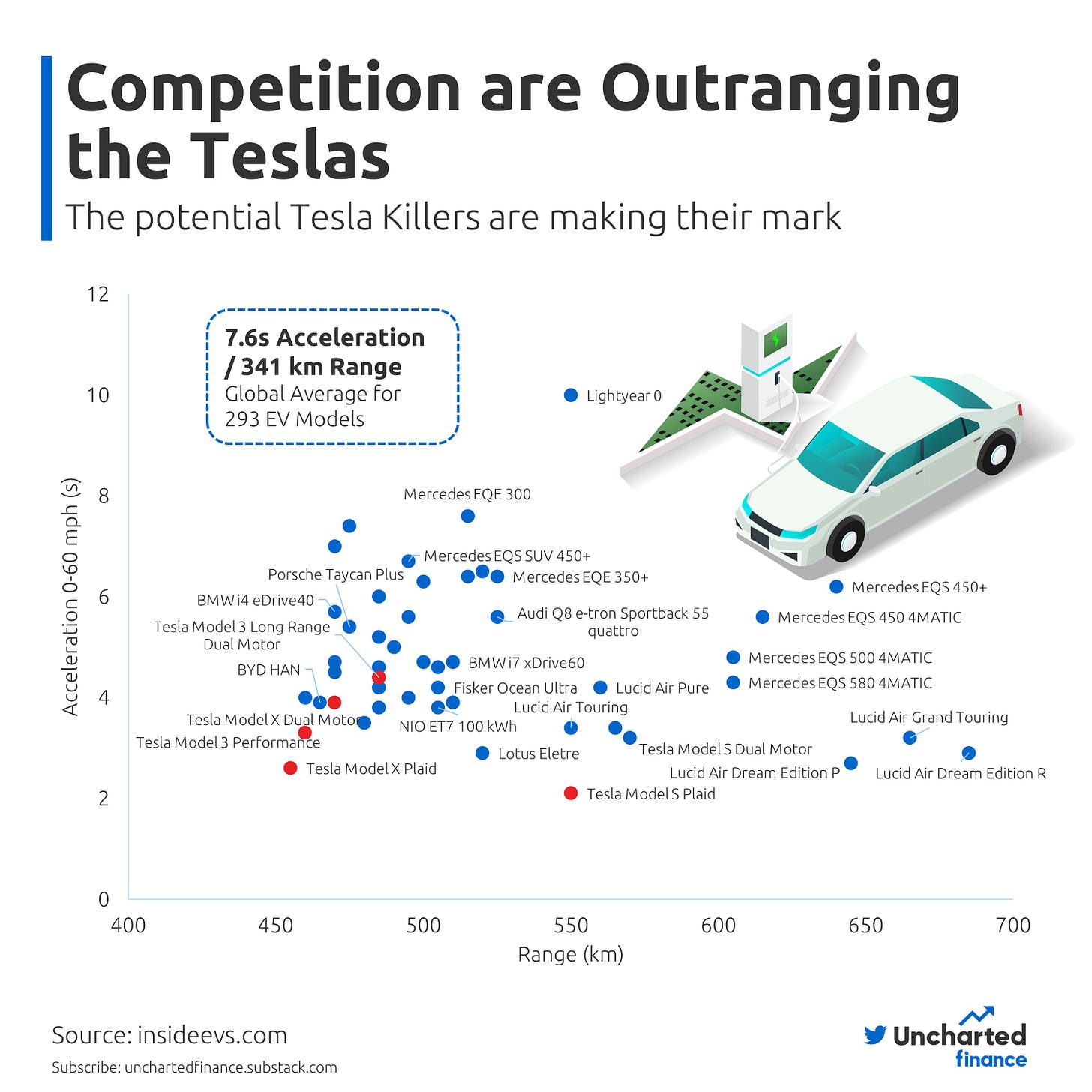

Established Automakers have jumped on the EV bandwagon along with nascent EV startups: can they take on Tesla, at least tech-wise?

What do you think?

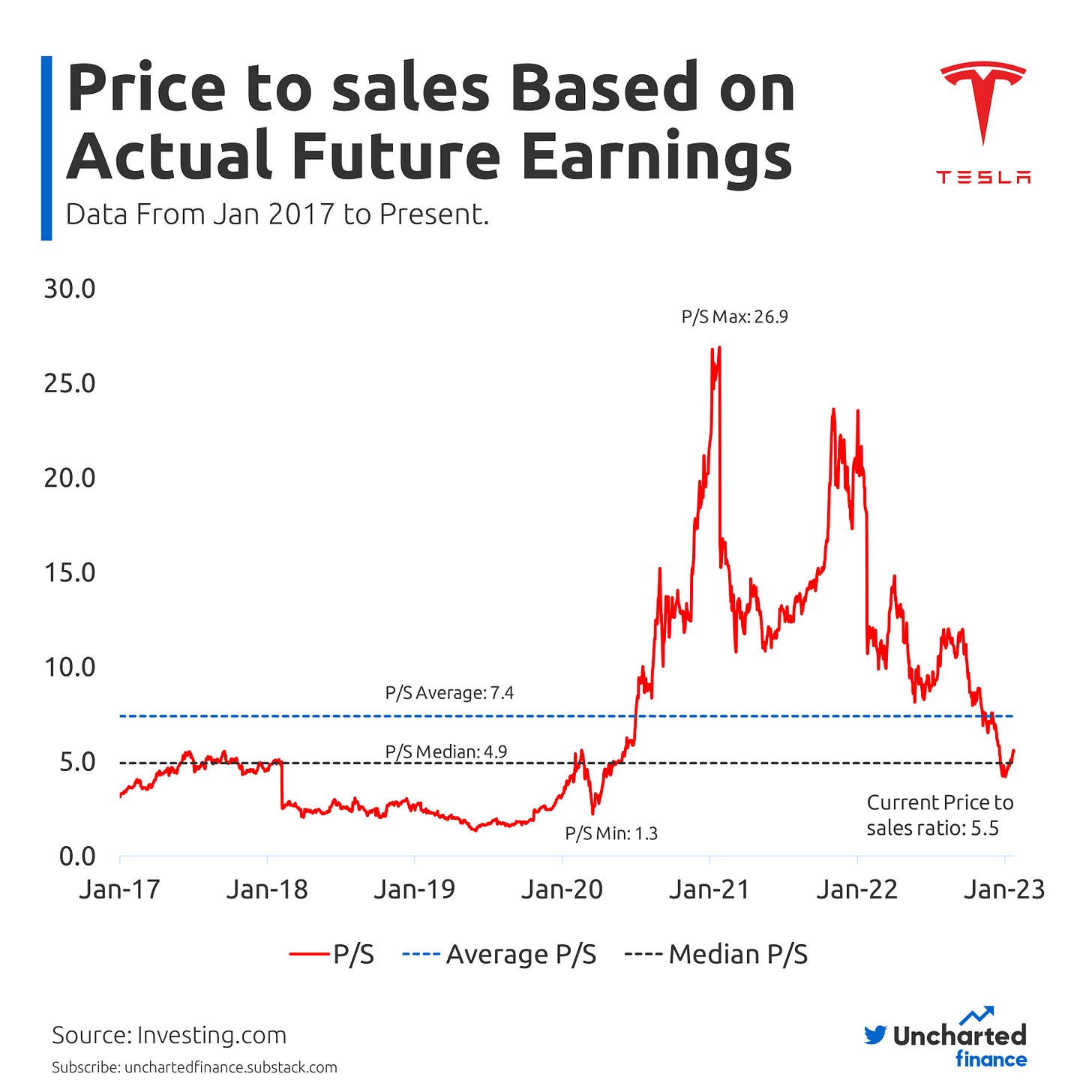

Investing in Tesla

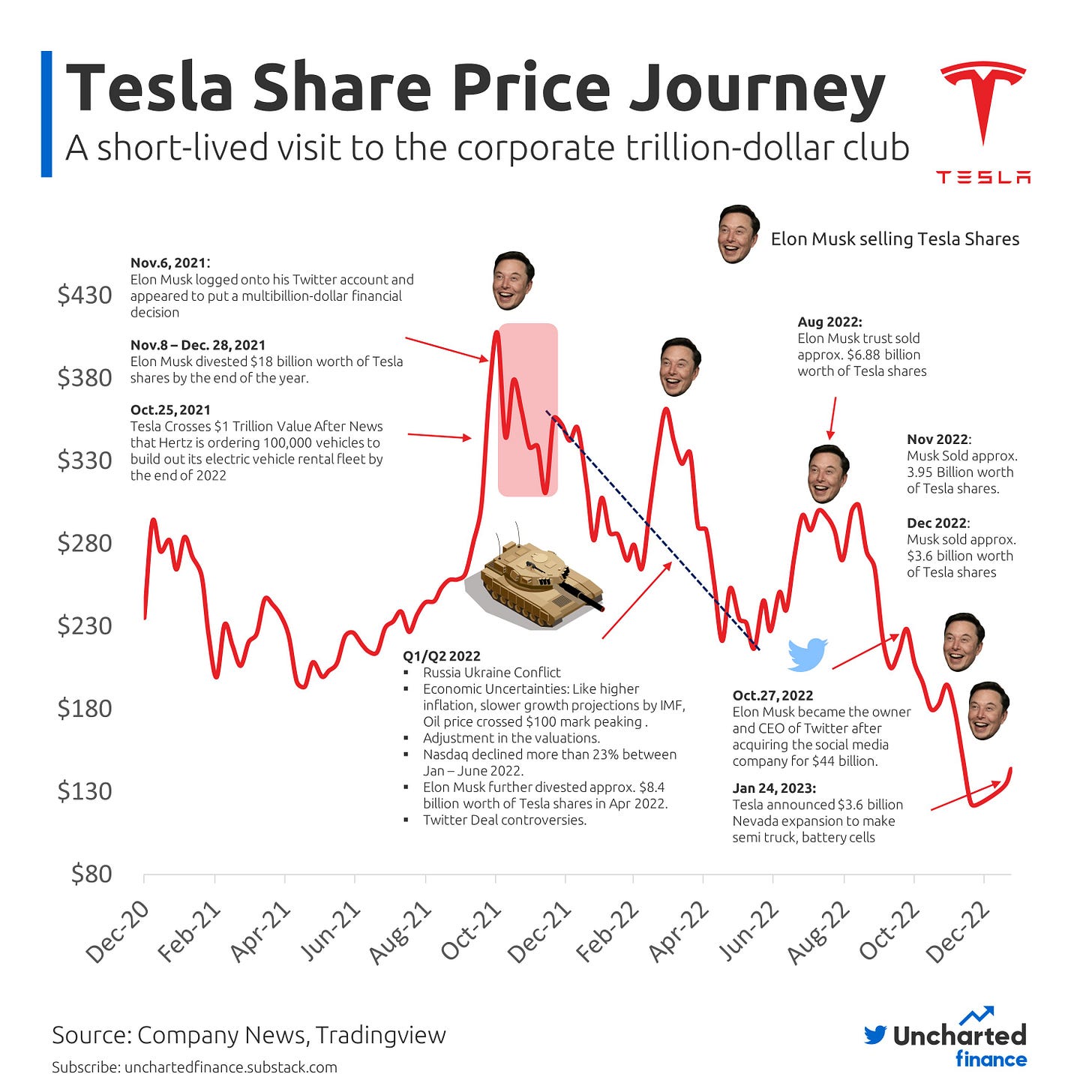

Tesla’s share price 2021-2022

Tesla’s share price has been a rollercoaster ride over the past two years, reaching a new valuation milestone amid impactful internal and external events.

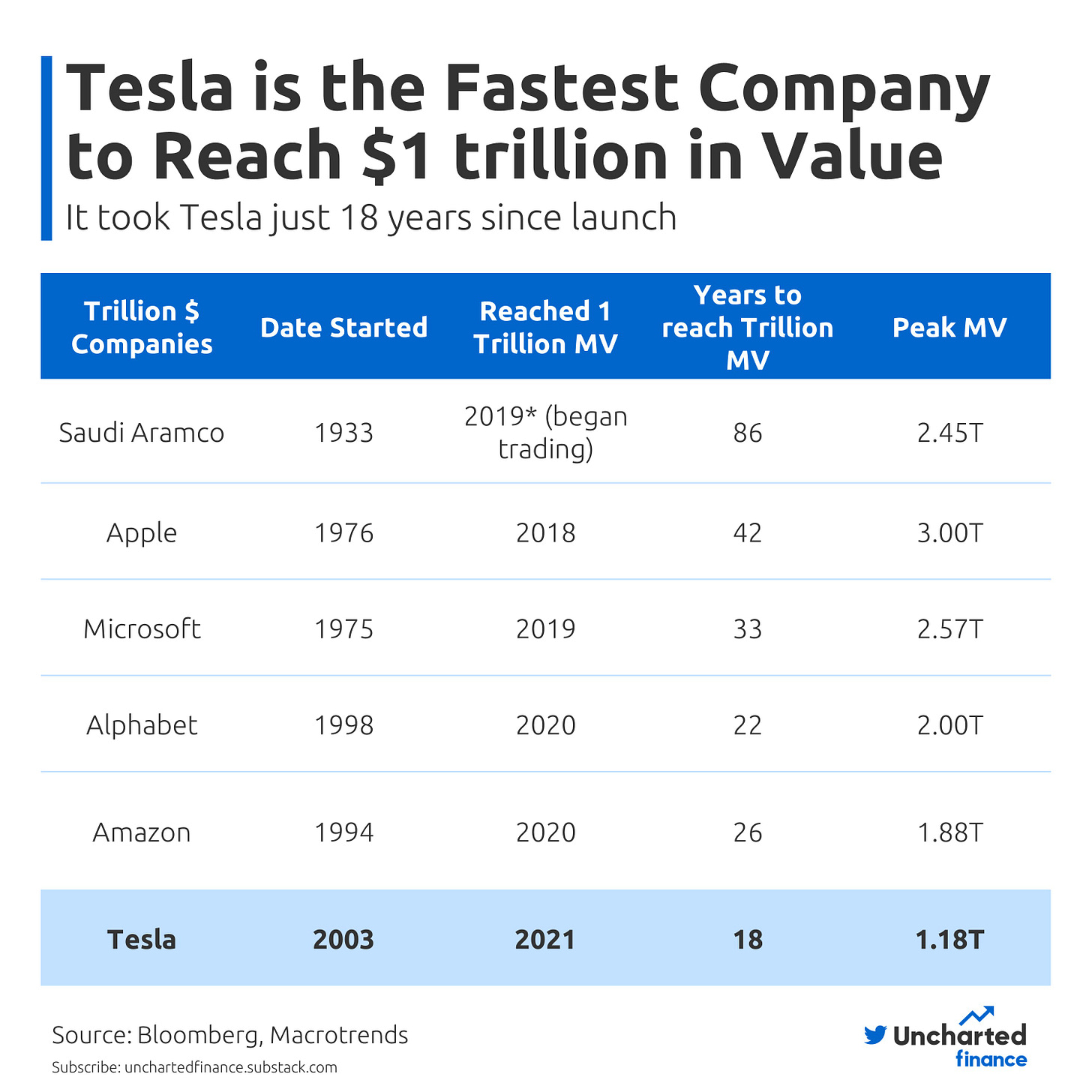

A Closer Look into Tesla’s $1 trillion Club Cameo

Tesla is the fastest company to reach $1 trillion in market value, breaching the milestone ~18 years after launch.

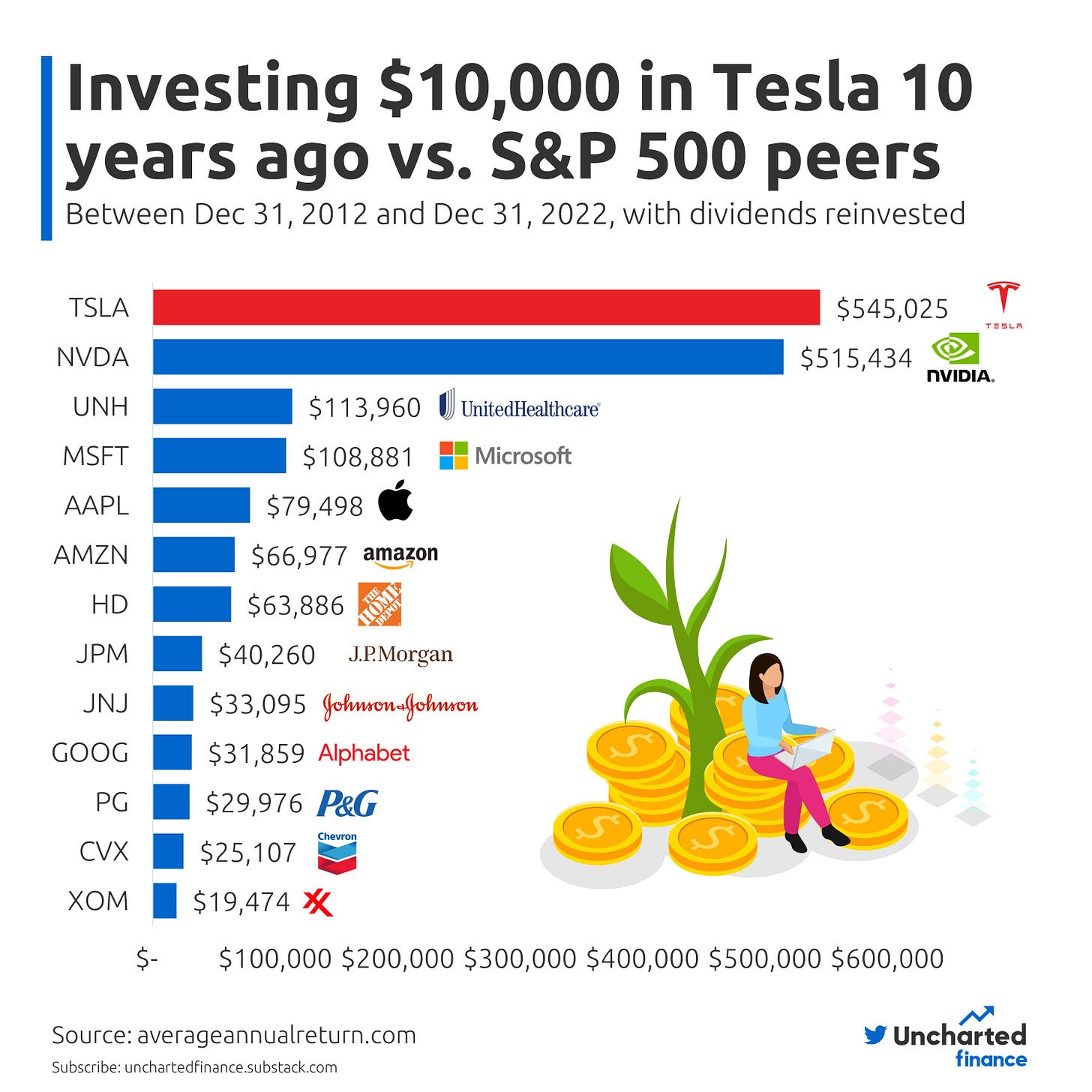

Investing $10,000 in Tesla 10 years ago

Compared to its major peers in the S&P 500, Tesla was by far the most rewarding stock in the past 10 years.

A $10,000 invested in Tesla on December 31st, 2012 would have turned into $545,000!

In comparison, investing $10,000 in the most valuable company in the world, Apple Inc. would have yielded around $80,000

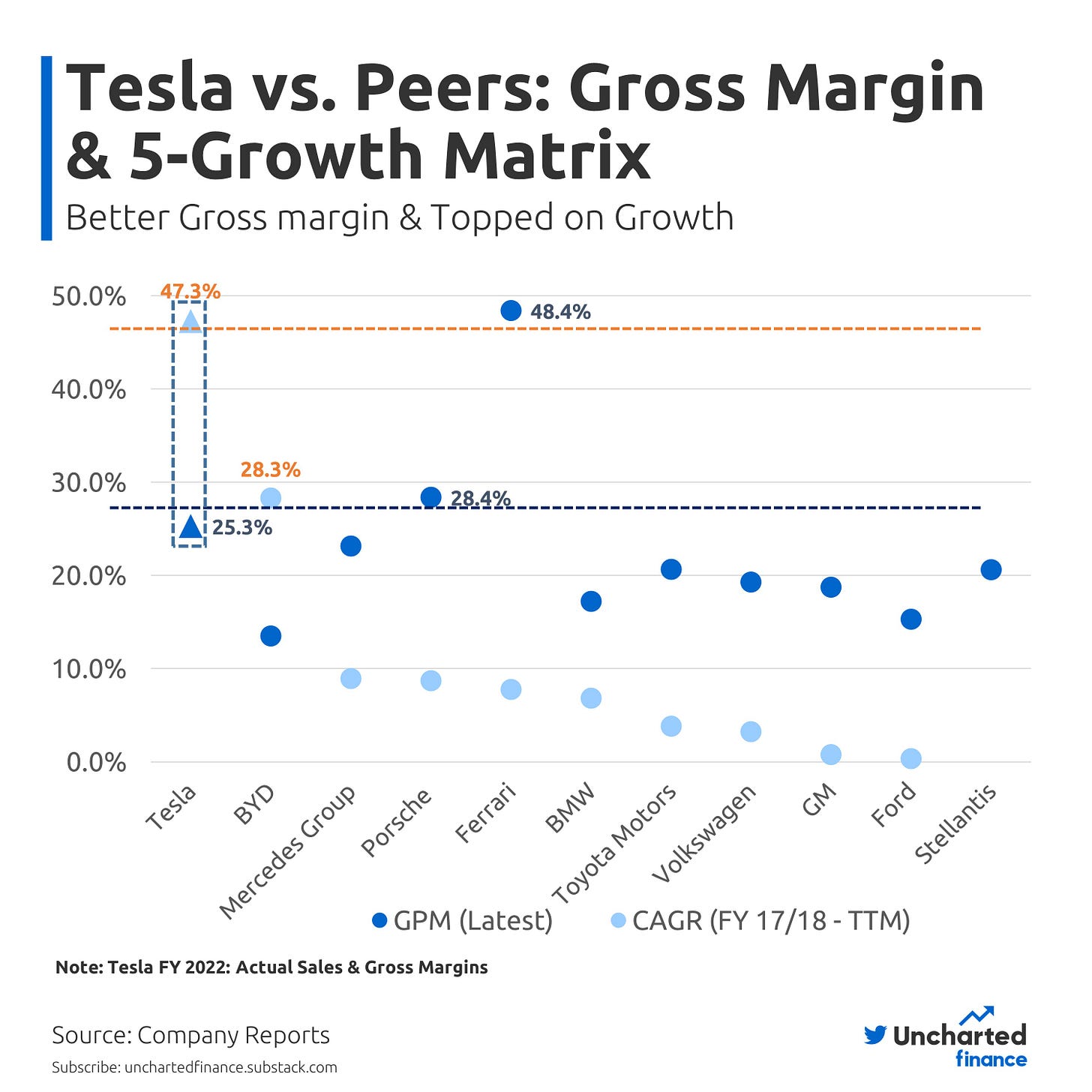

Tesla’s Valuation, is it justified?

Buzzing the News: Tesla slashes prices!

Tesla significantly reduced the prices of its new vehicles by up to 20% in January 2023, making them more financially accessible and potentially qualifying them for federal tax incentives.

One of the criteria for a vehicle to qualify for the federal EV tax credit is that it must not exceed a certain price threshold. Specifically, the vehicle must be priced at no more than $55,000 for sedans and $80,000 for SUVs and trucks.

A new tax credit worth a maximum of $4,000 for used electric vehicles would be implemented.

Tesla lowered the prices of its Model 3 and Model Y vehicles in several European countries, including Austria, France, Germany, the Netherlands, Norway, Switzerland, and the United Kingdom.

Tesla's decision to lower prices may serve as a strategy to boost demand and increase sales volume in the future as competition in the electric vehicle market intensifies with new players entering the field.

Bonus: Timeline of Tesla’s Rise to Stardom

Musk's leadership has been instrumental in driving the company's rapid growth and expansion. Under his direction, Tesla has become one of the world's leading manufacturers of electric vehicles, with the Tesla Model S, Model X, and Model 3 becoming some of the best-selling electric cars in the world. In addition, the company has also expanded into other areas such as solar energy and energy storage and has built a large and dedicated customer base.

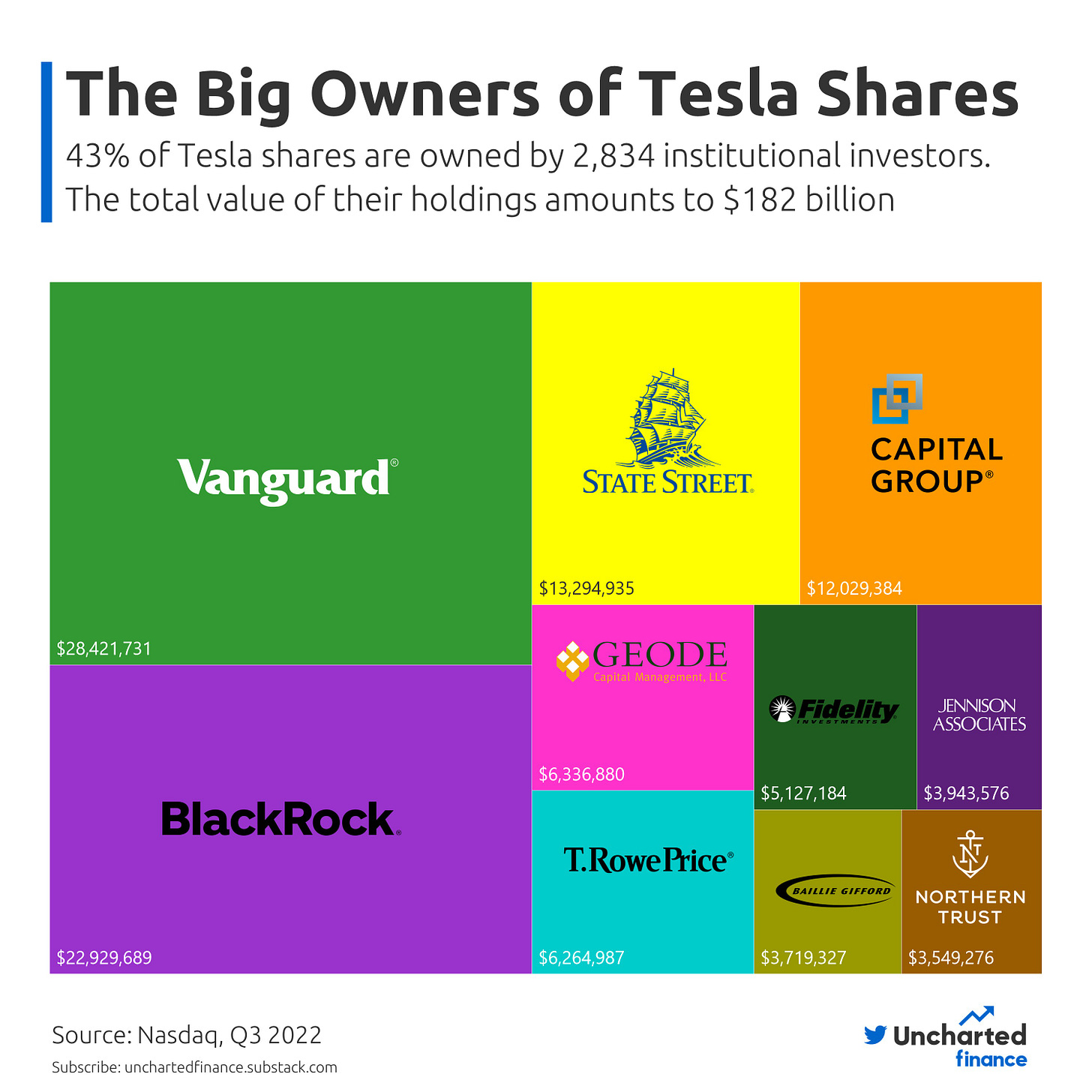

Big institutional investors with the biggest bets on Tesla

DISCLAIMER: The information provided on this blog is for informational purposes only and should not be considered financial advice. The content on this blog is not intended to be a substitute for professional financial advice, and we recommend that you seek the advice of a qualified financial advisor before making any investment decisions. We do not guarantee the accuracy, completeness, or reliability of the information on this blog, and we will not be held responsible for any errors or omissions or any actions taken based on the information provided. The views and opinions expressed on this blog are those of the authors and do not necessarily reflect the official policies or positions of any company or organization.